There’s a new 1040 crypto question, and it means the IRS will be asking all US taxpayers about crypto on the 2020 tax return.

Form 1040 is the standard tax form that everyone has to file each year, and the IRS crypto question is now being placed front-and-center.

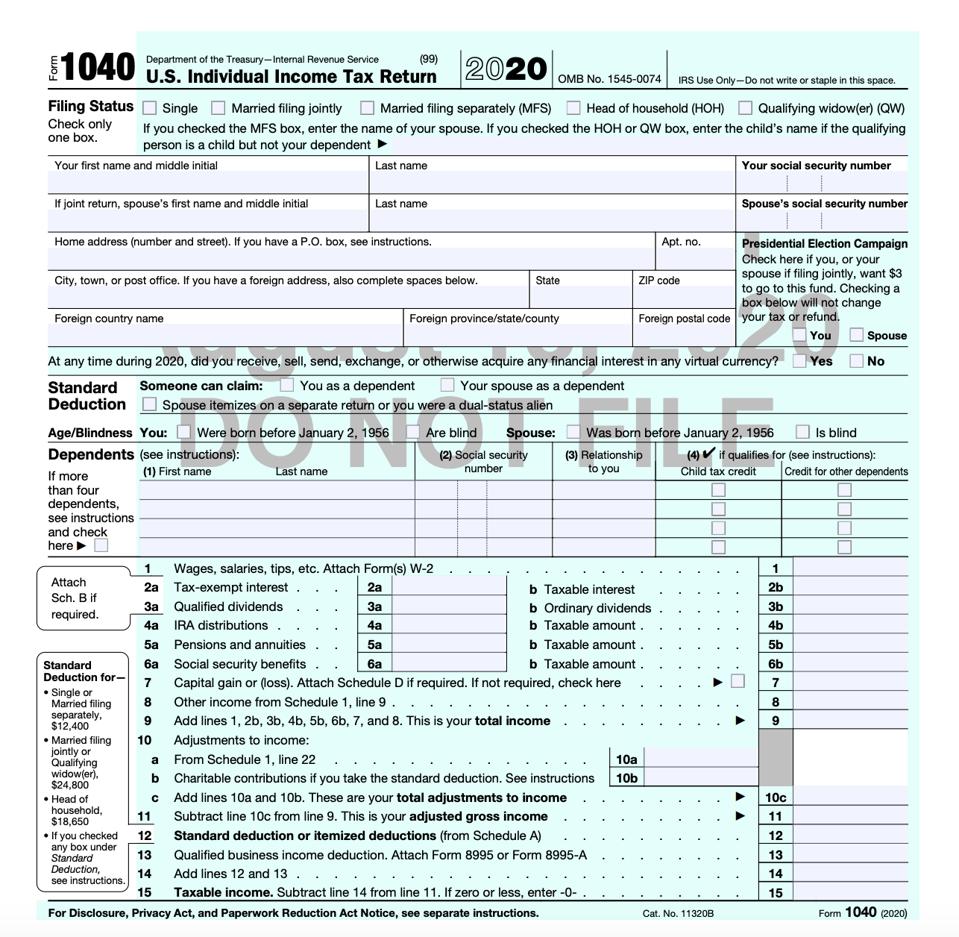

Just beneath name and address, the new Form 1040 asks: “At any time in 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

The IRS crypto question is prominently featured on Form 1040 for 2020 tax returns.

Do I Need to Answer Yes to the IRS Crypto Question?

If you touched cryptocurrency during the year, it’s likely you will need to check “yes” to the IRS crypto question.

Holding is virtually the only cryptocurrency activity that’s not specifically mentioned in the question—and therefore does not require you to check “yes.” However, be mindful that if you received any airdrops, that is considered “acquiring financial interest in virtual currency”; in this case, you must answer “yes” and report the airdrop(s) as income.

All the following activities are considered a sale of the crypto, which would require you to answer “yes” to the crypto question:

- Exchanging cryptocurrency for USD/fiat

- Exchanging one type of coin for another

- Purchasing goods or services with cryptocurrency

Read our cryptocurrency tax FAQ to learn more about reporting and why these activities are taxable transactions.

Please note that, question or no question, reporting cryptocurrency income or gains has always been required by law.

Update March 4, 2021: The IRS released new guidance stating: “If your only transactions involving virtual currency during 2020 were purchases of virtual currency with real currency, you are not required to answer yes to the Form 1040 question.” However, risk-averse taxpayers may still want to include a full report. Please contact our cryptocurrency tax lawyers to discuss the pros and cons of answering “No” to the crypto question.

The Crypto Question for 2020 vs 2019

This crypto question was on the 2019 tax return, too, but the new placement is much harder to miss. On the 2019 tax return, the IRS crypto question was located on Schedule 1 of Form 1040, which reports certain types of income and exclusions from taxable income. Although the implications of the 2019 question were significant—we considered it a “legal landmine”—some taxpayers may have reasonably overlooked the Schedule 1 form altogether.

Now, however, every taxpayer will be hard pressed to claim that they missed the 1040 crypto question.

Why the Crypto Question on Form 1040 Matters

The 1040 crypto question can only be answered “yes” or “no”—not a lot of wiggle room, legally speaking. And yet this simple question could potentially land crypto traders in jail if they answer falsely.

When you’re dealing with the IRS, the difference between small penalties and severe ones typically comes down to the concept of willfulness. Did you knowingly try to cheat the IRS, or did you make an honest mistake? The IRS wants to make an example of willful tax violators and will often treat them much more harshly.

If you check “no” to the question—“At any time in 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”—when you did in fact engage in any of those activities, it will be very difficult to argue that you made a non-willful mistake.

Look at Offshore Tax Treatment to Guess the IRS’s Next Move

We’ve long used our knowledge of offshore taxes to predict how the IRS will treat cryptocurrency, and the new 1040 crypto question comes right out of the IRS’s past playbook.

For decades, US taxpayers hid their funds in overseas bank accounts, thinking the IRS would never be able to track them. Sound familiar?

But the IRS caught on and, as always, wanted its cut. Eventually, the IRS began requiring individuals with foreign financial accounts to disclose their account information, even going so far as to ask about foreign accounts with straightforward, yes-or-no questions.

Since then, the IRS has established in many criminal cases that by checking “no” to the questions about foreign accounts, an individual was willful in their failure to report. This has often made the difference between purely financial penalties and extreme penalties such as prison time.

I Checked “Yes” to the 1040 Crypto Question. Now What?

Checking “yes” is just the first step; you’ll also need to report crypto activity on your tax return. This is usually reported on Form 8949, but occasionally crypto is treated as income and should be reported elsewhere.

Just because you have to report your crypto activity, that doesn’t mean you’ll automatically owe taxes on it. However, even if you owe no crypto tax, you must report; not doing so may be seen as tax fraud by the IRS.

Read our Cryptocurrency Tax Guide for a crash course in how the IRS treats crypto.

The New 1040 Form Foreshadows Heightened Crypto Scrutiny (Even More Than Before)

We’ve been warning of increased cryptocurrency audits for some time, but the prominent placement of the IRS crypto question on Form 1040 signals more clearly than ever that the IRS is cracking down on cryptocurrency reporting.

Here’s a quick snapshot of the IRS’s efforts to enforce crypto tax reporting:

- 2014: The IRS released its first official guidance on cryptocurrency taxation, Notice 2014-21.

- 2017: Coinbase was forced to hand the IRS trading records on over 14,000 of its users. Ever since, Coinbase has sent the IRS information on select users, particularly those with 200+ trades worth $20,000 or more.

- 2018: The IRS Large Business & International division announced a virtual currency compliance campaign.

- 2019: The IRS sent over 10,000 warning letters to crypto traders who hadn’t fully reported their virtual currency.

- 2020: The IRS added a yes-or-no question regarding virtual currency holdings to the top of Schedule 1 (Form 1040).

- 2020: The IRS began recruiting more cryptocurrency tax professionals to assist with crypto audits.

- 2021: The yes-or-no IRS crypto question was moved to the beginning of the standard 1040 tax form.

If you haven’t been reporting your crypto correctly, now’s the time to get your ducks in a row, because the IRS clearly means business. But before you lose sleep over your unreported crypto, call Gordon Law Group. We’ve helped hundreds of traders report crypto taxes and fix their reporting for past years, and we can help you, too!