The IRS 83(b) election can be a powerful tax-saving tool that allows startup founders, employees, and independent contractors to pay tax on the fair market value of stock when it’s granted, rather than when it’s received. In many cases, this tax trick can significantly reduce the federal tax burden for startup stock grantees.

One of the most common startup mistakes we see in our practice is failing to make this tax election within the IRS’s strict time limit. Read on to learn why the 83(b) election is so powerful and how to use it!

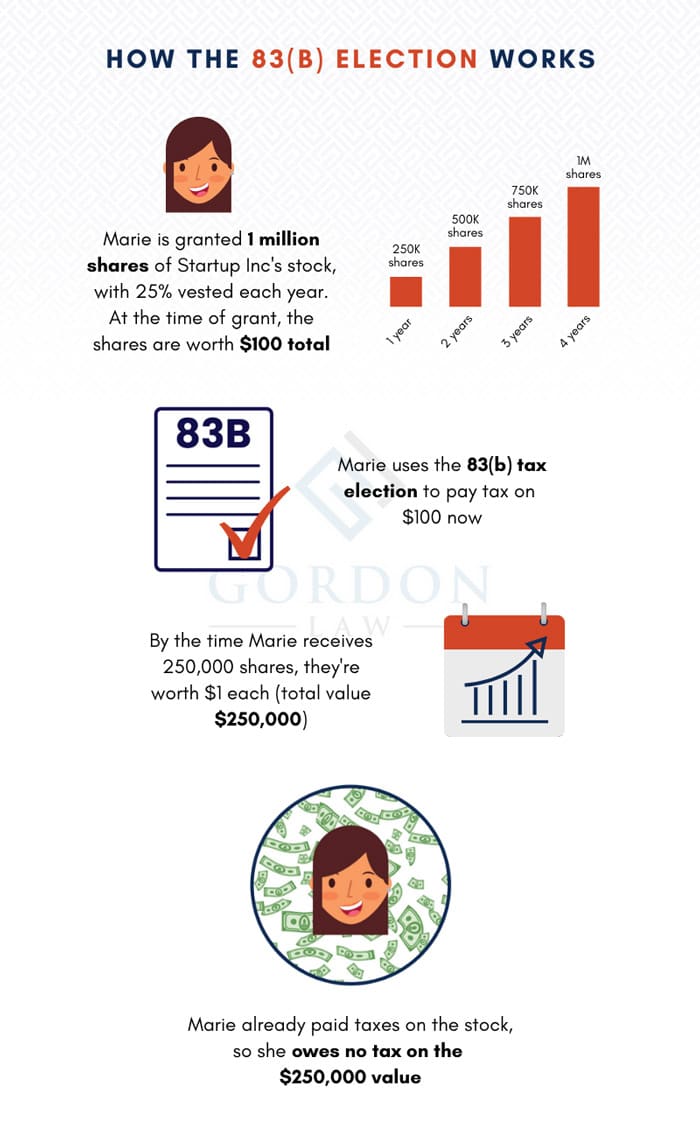

How the 83(b) election works

If you’re a startup founder, investor, employee, or independent contractor receiving equity, you should pay attention to the 83(b) election.

Many startups grant equity, or stock, early on but subject the shares to a vesting schedule, meaning they’re received over time.

Typically, the stock is not worth much at the time it’s granted, but the expectation is that its value will grow. By the time the stock is received (vested), its value could be significantly higher.

The IRS 83(b) election allows you to declare the value of the stock upon its grant and pay taxes on its value at that time, instead of paying taxes when the stock vests later.

If the stock’s value grows over time (which, of course, is the goal), the 83(b) election can significantly reduce your federal tax burden—often by several thousands of dollars.

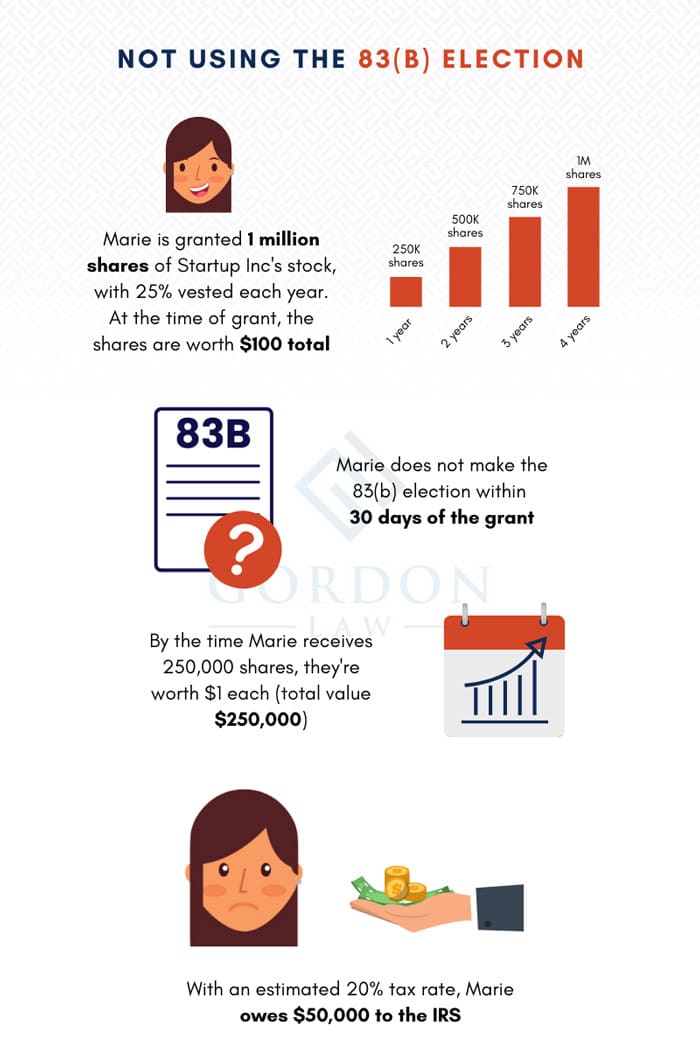

What happens if you don’t make the 83(b) election?

If you don’t make this election and don’t plan for a potential tax burden, the results can be disastrous. Unfortunately, we’ve seen this happen a lot.

Without the 83(b) election, you’ll need to claim your stock when it’s received and pay taxes on the fair market value at that time. For example, say the stock you receive is now worth $250,000. Using a basic estimated tax rate of 20%, you’d owe $50,000 to the IRS (and possibly additional tax to your state).

But the real problem arises when the stock you’ve received is not actually liquid. If the company isn’t IPO-ed yet, you can’t sell the stock, so where do you get the money to pay your tax bill?

Some people have to dip into personal savings, while others simply don’t pay the bill and end up with significant tax debt.

IRS debt can quickly spiral out of control thanks to penalties and interest. Additionally, the IRS has various collection tools at its disposal, including freezing bank accounts, levying wages, and even seizing assets. You certainly don’t want to end up in any of those predicaments.

There’s a strict 30-day deadline to file

To take advantage of the IRS 83(b) election, you must file the request within 30 days of the date the stock is granted. If you miss the deadline, there are some options to try to repair the damage later on, but it’s very difficult to retroactively correct that mistake.

Should anyone not use the 83(b) election?

This election provides an advantage when you start with low-value stock that is expected to increase in value. If the stock’s value is already high, or if it will decrease in the future, it may not make sense to use the 83(b) election.

It is incredibly difficult to reverse an IRS 83(b) election, so if you make the election and then the stock’s value drops, you’re out of luck. You’ll have already paid tax on the higher value.

It’s important to fully understand your options, and we highly recommend seeking experienced startup tax counsel. At Gordon Law Group, our tax and business lawyers provide a holistic approach that can save you significant money in the long run. Give us a call if you need help!