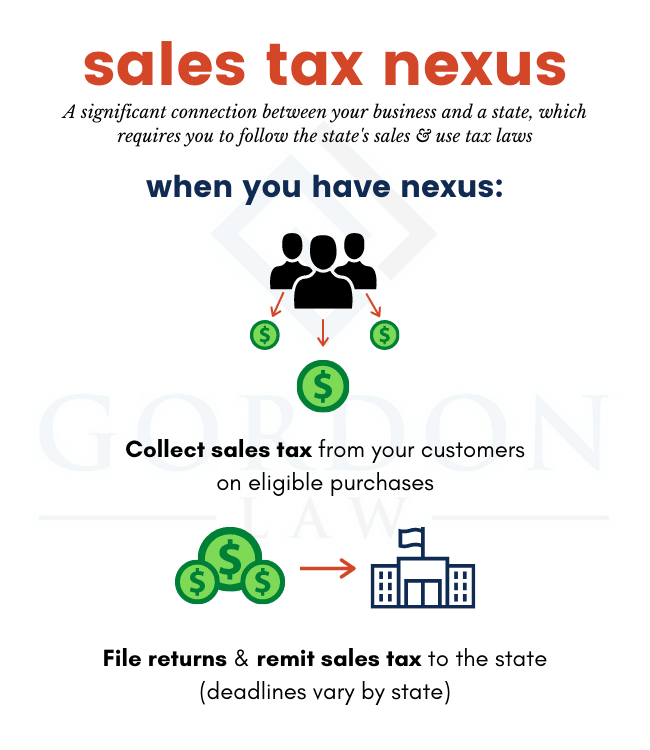

What is sales tax nexus, and why is it so important? Sales tax nexus is essentially a significant connection between a business and a state.

It could be caused by your business’s physical connection to the state, or by doing significant business with customers in that state. Each state has its own set of rules regarding who has nexus.

When you have sales tax nexus with a certain state, you must follow that state’s laws regarding sales and use tax. That usually means collecting sales tax from customers and remitting it to the state.

Many business owners trigger nexus in multiple states without even realizing it, and this can lead to a tax disaster.

Ignoring sales tax nexus: What’s the worst that could happen?

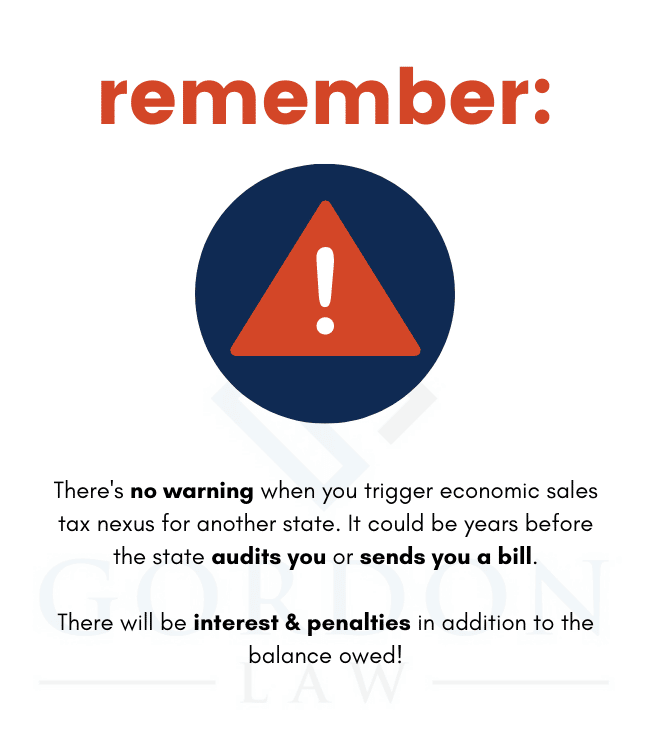

What if you weren’t aware of your all your sales tax obligations for different states, and you haven’t been collecting and remitting sales tax as you should have been? Nothing may happen… for a while. But if any state decides to conduct a sales tax audit of your business, then you’re in trouble.

Triggering sales tax nexus doesn’t come with an alert or a warning. It could be years before the state catches on and selects you for an audit. Typically, the longer the problem goes unnoticed, the worse results you’ll have in the end.

Normally, sales tax is paid by your customers; you collect it from them and remit it to the state. If, however, you haven’t been collecting the proper tax from your customers, and a state tax board decides that you owe, then your company will be on the hook for the full amount of back taxes—plus penalties and interest.

Imagine you’ve been running your Chicago-based business for 10 years when the state of California calls you up to collect a decade worth of sales and use taxes. With the penalties and interest adding up over years, that bill can be astronomical, and you’ll have to figure out how to pay.

But an ounce of prevention is worth a pound of cure, as they say. Getting a tax professional to review your state tax obligations now can save your wallet and your sanity down the line! Our experienced tax lawyers can review your business for sales tax nexus in all 50 states.

How do I know if I have sales tax nexus?

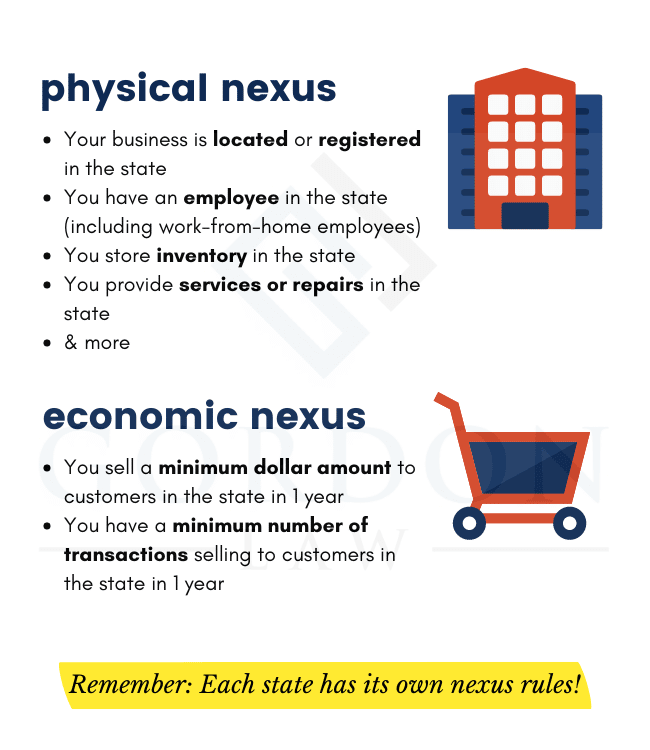

There are 2 types of sales tax nexus which you need to assess state by state:

- Physical nexus: Having physical ties to the state

- Economic nexus: Selling a minimum amount to customers in the state

We’ll cover both types of nexus in detail below.

It’s important to understand that determining your sales tax obligations is not a one-and-done exercise; state laws can change, and you may hit nexus in new states as your business grows.

We recommend reviewing your state tax obligations each year to avoid getting hit with devastating tax bills.

Understanding physical nexus for sales tax

If you’re wondering which states you have nexus in, physical presence should be your first consideration. For example, if your company is located in Illinois, you automatically have sales tax nexus in Illinois.

Here are some other situations that commonly trigger sales tax nexus based on physical presence:

- Having an office in the state

- Having an employee in the state (see our guide to remote working tax implications)

- Having inventory that you own stored in the state, including inventory kept in a third-party warehouse

- Attending a trade show in the state

- Making in-person sales calls in the state

- Conducting services or repairs in the state

- Having an affiliate relationship with a business in the state

Each state has its own rules and minimum thresholds for each of these activities.

Understanding economic nexus

Even if you have no physical presence in a certain state, you could have sufficient economic presence to trigger sales tax nexus.

Economic nexus is determined by where your customers live and how much you sell to customers within each state. For example, if you sell $100,000 worth of goods to customers who live in Illinois, you may be subject to Illinois sales and use tax laws.

The concept of economic nexus is relatively new; it began with the landmark Supreme Court case South Dakota v. Wayfair in 2018. Prior to the online shopping era, physical nexus was the only factor in a business’s sales and use tax obligations. But the Supreme Court ruled in Wayfair that South Dakota could require sales tax to be collected and remitted by Wayfair, a major ecommerce retailer, despite its out-of-state location.

That decision opened the floodgates for other states to follow suit. Today, nearly every state in America has established an economic nexus threshold for sales tax.

For many states, that’s $100,000 in sales or 200 transactions in a year—meaning that if you sell at least $100,000 worth of goods to customers in the state, OR have at least 200 transactions selling to customers in the state, you’ll be subject to the state’s sales and use tax laws.

But here’s the fun (read: wildly confusing) part: Each state has its own economic nexus thresholds. They also have different rules about which transactions to include in your calculations—whether that’s gross sales, retail sales, sales of taxable items, or sales of services.

As you can imagine, figuring out which states you might have sales tax nexus in can be extremely complex, but state tax boards don’t have much sympathy for businesses that fail to fork over the required dough. To prevent being surprised with a massive sales tax bill, businesses selling to out-of-state customers should review their sales tax nexus at least once per year.

What happens when you trigger nexus in another state?

1. Registration:

Your business could trigger sales tax nexus in another state at any time. Many states require that you almost immediately register for a sales tax permit after reaching the economic nexus threshold.

2. Collecting Sales Tax:

Then, you’ll need to start collecting sales tax from customers in that state. Most ecommerce platforms, including Shopify, have options to do so automatically.

Keep in mind: In many states, marketplace facilitators like Amazon, Etsy, and eBay are required to collect and remit sales tax on your behalf. However, in some states you still need to obtain a sales tax permit and file sales tax returns.

3. Remitting Sales Tax:

By now, you probably get the idea that each state has its own way of doing things when it comes to sales tax. Remitting the sales tax that you’ve collected is no exception. You’ll need to follow each states’ filing and payment schedules.

Keep in mind: Collecting sales tax from your customers and failing to remit it to the state can lead to severe penalties.

Invest in a sales tax review

As we mentioned above, it may take years for a state to notify you of delinquent sales and use taxes—and by the time that happens, the consequences could spell disaster for your business. The taxes that should have been collected from your customers will instead be your responsibility, with penalties and interest tacked on. These bills can easily reach hundreds of thousands of dollars.

Our experienced sales tax attorneys can assist with Illinois sales tax audits and bills. For businesses located in Illinois, we can also review your sales tax exposure, weigh your audit risk for each state where you’ve triggered sales tax nexus, and work with you to design an action plan. Contact us today for a confidential consultation!