The Qualified Small Business Stock (QSBS) tax exemption is a very powerful tax saving tool for those who qualify—it can save millions of dollars in federal taxes!

The QSBS exemption is also known as the Section 1202 exclusion, based on the section of the Internal Revenue Code (IRS) that covers QSBS rules.

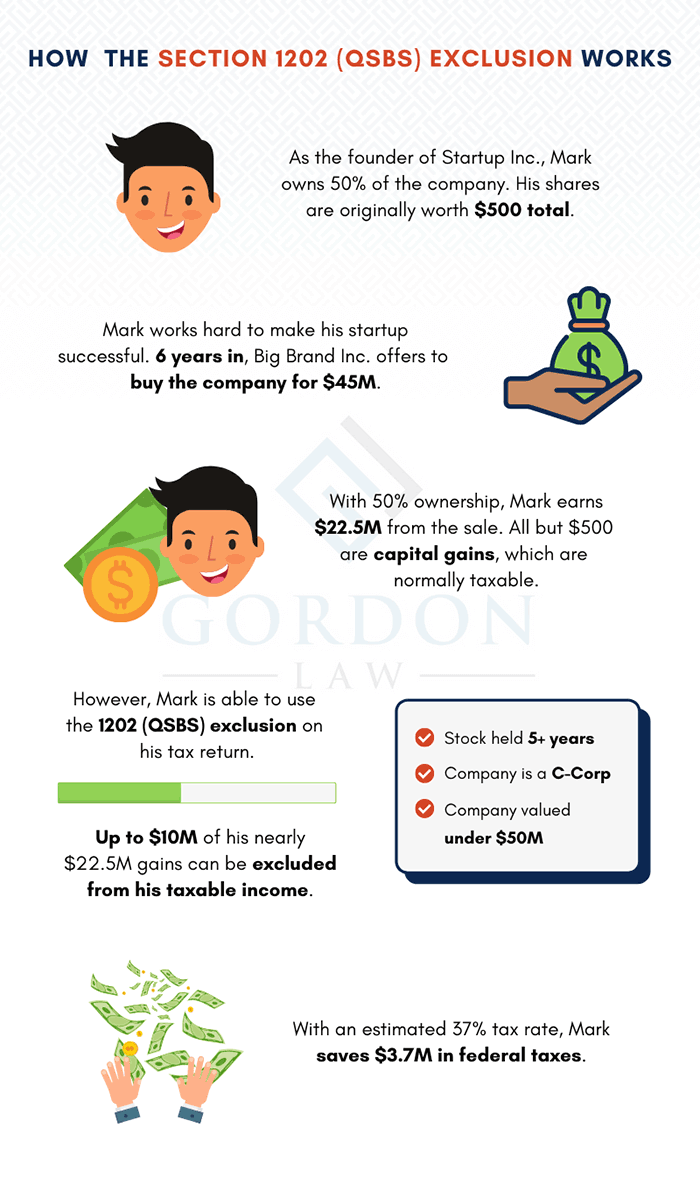

The QSBS/Section 1202 exclusion is for startup founders, investors, employees, or others who receive stock in a qualifying company. It allows the stockholder to save on taxes by excluding 100% of capital gains from the sale of qualifying stock—up to $10 million or 10 times the initial investment, whichever is greater. That means you could earn $10 million or more completely tax-free!

Unfortunately, many people don’t know about this incredible tax hack and fail to take advantage of their potential tax savings. Read on to see who qualifies for the Section 1202 exclusion and how to use it.

How much can you save with Section 1202 stock/QSBS?

The Section 1202 exclusion can yield significant tax savings on capital gains. Up to $10 million in capital gains, or sometimes more, can be excluded from taxable income; with an estimated tax rate of 37%, that would automatically save $3.7 million in taxes!

Even if your gains exceed the exclusion threshold, you can still enjoy significant tax savings on the qualifying amount. This infographic highlights how it works:

QSBS rules: Who qualifies for these savings?

Typically, you can use the Section 1202 exclusion if:

- Your stock was issued after August 10, 1993

- The stock was issued by a domestic C-Corp

- The company is a Qualifying Small Business (QSB); it must be valued below $50 million from the time the stock is issued to you through the time you sell it, along with meeting other QSB criteria

- You’ve held the stock for 5 years or more

- You’re a non-corporate taxpayer

- The company is actively running; at least 80% of assets must be in use and not held for investment purposes

Let’s take a closer look at some of those QSBS rules.

The stock must be issued by a domestic C-Corp

This is an important consideration for founders when starting a business. The typical modern startup—the kind featured in Silicon Valley—is usually structured as a C-Corp; however, for small businesses with just one or two owners, the C-Corp structure doesn’t always make sense.

It’s important to weigh all your tax and business considerations when forming a business. This is one of our core practices at Gordon Law Group, so please reach out if you need help.

The company must be a Qualifying Small Business (QSB)

- Certain industries are automatically excluded from the QSB definition, including financial, hospitality, farming, mining, and services “where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees.”

- The company must be valued at less than $50 million when the stock is issued and until you dispose of the stock.

- You should use accurate valuations prepared by an accountant or other qualified third party.

- Be sure to retain proof of the company’s valuation! If you’re audited after using the QSBS exclusion (see below), this record will be crucial.

You must hold the stock for 5 years or more (usually)

This is an important qualification for the Section 1202 exclusion. If you plan to use this tax saving tool, be sure to keep records of when you received the stock and when it was sold.

It is possible to sell QSBS in less than 5 years without giving up your tax savings, if you use the proceeds to buy stock in another Qualifying Small Business. This is known as a “1045 rollover.”

How to use the QSBS exemption

Unlike the 83(b) election (another fantastic tax saving tool for startups), the QSBS exclusion does not need to be claimed as soon as the qualifying stock is received. Instead, when you sell the QSBS and have capital gains, you’ll mark the Section 1202 exclusion on your tax return for that year.

If you failed to take advantage of Section 1202 on your tax return, you can go back and amend the return to claim the benefits. Although you generally only have 3 years to amend a tax return to claim a refund, there is no time limit to amend a tax return in order to lower the tax due.

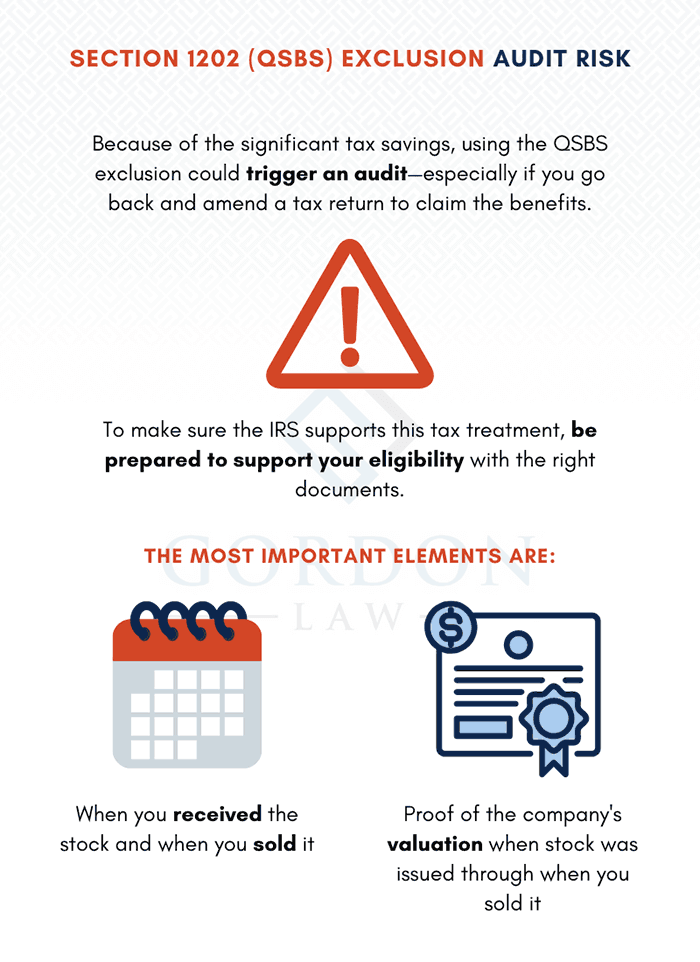

Be prepared for QSBS audit risk

The one downside of the Section 1202 exclusion is the audit risk. Because of the significant tax savings involved, using this exclusion could cause the IRS to take a closer look, especially if you amend an old tax return to claim the benefits.

If your QSBS exclusion triggers an audit, you will need to support each element of eligibility—most importantly, how long you held the stock and the company’s value from the time the stock was issued until the date you disposed of the stock.

Usually, the IRS has 3 years to initiate an audit. However, depending on the circumstances, that time window could be extended to 6 years or even indefinitely. We highly recommend hanging on to your QSBS records for as long as possible. (Learn more about how long to keep tax records.)

You may be able to prevent an audit by attaching supporting documents along with your tax return when you claim the Section 1202 exclusion.

If you are audited and you can’t support your eligibility for this exclusion, the results could be disastrous. Say you initially saved $3.5 million in federal taxes using Section 1202/QSBS. If the IRS does not accept those savings, you’ll owe the full amount plus penalties (up to 25%) and interest. So be sure to consult an experienced professional!

Aggressive tax planning for startups and beyond

Gordon Law Group offers a 360° approach to business and tax law that helps set you up for long-lasting success. We’ve found that the initial investment in experienced legal counsel often saves our clients thousands, if not millions, of dollars down the road.

Call our startup lawyers at 847-584-1426 or use the contact form below to schedule a confidential consultation!