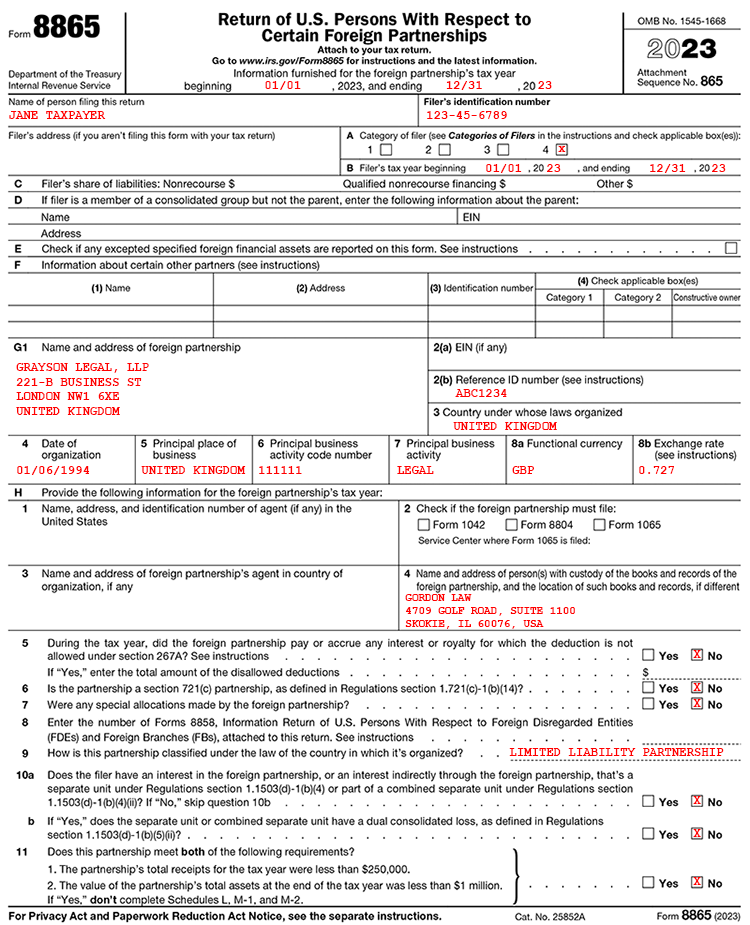

Understanding Form 8865, “Return of U.S. Persons With Respect to Certain Foreign Partnerships,” is key for anyone involved in foreign partnerships. This form, crucial for international tax compliance, can be complex and challenging for the average taxpayer. It requires detailed information about foreign partnerships and U.S. persons’ roles in them.

Filing this form correctly and avoiding IRS penalties requires a tax professional with focused experience in international tax law. At Gordon Law, we have years of experience with offshore tax compliance, and we’re dedicated to providing a stress-free tax season for everyone.

In this guide, we’ll demystify Form 8865, outlining who needs to file, the different categories of filers, and the information required.

What Is Form 8865?

Form 8865, “Return of U.S. Persons With Respect to Certain Foreign Partnerships,” is a form required by the IRS for U.S. persons to report their involvement in foreign partnerships.

Unlike a traditional tax return, Form 8865 is used primarily for informational purposes. It provides details about the partnership’s assets, income, losses, and transactions between the partnership and its U.S. partners.

This form plays a key role in the IRS’s efforts to track international financial activities and enforce U.S. tax laws related to foreign business operations and investments.

Form 8865 Filing Requirements: Who Needs to File?

Filing Form 8865 is mandatory for U.S. persons involved in foreign partnerships under specific circumstances. In a nutshell, filers include those who meet certain ownership thresholds and those who engage in reportable transactions.

Form 8865 is filed alongside your annual tax return. For individuals, the filing deadline is April 15 each year.

As you’ll see below, this form has several different categories of filers, each with their own requirements. There are many nuances, exceptions, and exclusions to the filing requirements, so be sure to reach out to an international tax professional if you have any questions.

8865 Category Filers: Understanding the Different Categories

There are multiple categories of Form 8865 filers. Your category determines which schedules you’ll have to file, so it’s important to choose accurately. You may fall into multiple categories, as well.

If you need help understanding your requirements, reach out to an international tax attorney today.

Category 1 – Control of Foreign Partnership

This includes U.S. persons who have more than 50% control in a foreign partnership during the tax year. Control is determined by either direct or indirect ownership of a majority interest in the partnership.

Category 2 – Shareholder of a Controlled Foreign Partnership

This category involves U.S. persons who own at least 10% of a Controlled Foreign Partnership (CFP).

A Controlled Foreign Partnership is a specific designation under U.S. tax law that has significant implications for filing Form 8865. A foreign partnership becomes a CFP when U.S. persons hold more than 50% of the partnership interest.

Category 3 – Property Contributions

This applies to U.S. persons who contribute property to a foreign partnership during the tax year. The filing requirement is triggered if:

- Immediately after the contribution, the individual owns at least a 10% interest in the partnership, or

- The value of the property contributed exceeds $100,000.

Category 4 – Acquisition, Disposition, and Changes in Ownership

This category covers U.S. persons who acquire, dispose of, or change their proportional interest in a foreign partnership. Here’s a breakdown of these scenarios:

- Reportable Acquisitions: Reportable acquisitions include either of the following scenarios:

- An individual who previously held less than a 10% interest in the foreign partnership acquires a 10% or greater interest through a transaction. For example, if someone previously held 5% interest, then purchases an additional 5% interest, bringing their total ownership stake to 10%.

- An individual’s ownership stake increases by 10% or more as a result of a transaction.

- Reportable Dispositions: Reportable dispositions are similar to reportable acquisitions, encompassing 2 potential scenarios:

- An an individual who held at least a 10% interest in the partnership reduces their ownership to fall below the 10% threshold.

- An individual’s ownership interest decreases by 10% or more due to a transaction.

- Changes in Proportional Interest: Reportable changes occur when an individual’s direct proportional interest in the partnership has shifted by at least 10%.

Instructions for Filing Form 8865

Filing Form 8865 is a crucial step in fulfilling your international tax obligations. To ensure compliance and accuracy, it’s essential to follow the IRS instructions carefully. Here’s an overview of key instructions for filing Form 8865:

- Gather Required Information: Before you begin, gather all the necessary information, including details about the foreign partnership, your ownership percentages, financial data, and any relevant transactions.

- Choose the Correct Filing Category: Determine the category that applies to your involvement in the foreign partnership.

- Complete the Form: Fill out Form 8865 accurately and provide all requested information. Be thorough in documenting your ownership and financial details.

- Attach the Required Schedules: Depending on your category, you may need to attach specific schedules to provide additional information (learn more below). Ensure you complete the relevant schedules correctly.

- File on Time: Pay attention to the filing deadlines. Form 8865 is typically due with your annual income tax return, including extensions if applicable.

- Seek Professional Guidance: If you have complex foreign partnership arrangements or are unsure about the filing requirements, don’t hesitate to reach out to our experienced tax professionals.

- Keep Records: Maintain records of your filed Form 8865 and supporting documents. Proper record-keeping is essential for future reference and potential IRS inquiries.

Remember that accurate and timely filing of Form 8865 is crucial to avoid penalties and ensure compliance with U.S. tax laws related to foreign partnerships. If you have questions or need assistance with filing Form 8865, contact us for a free consultation.

Form 8865 Schedules

The main portion of Form 8865 reports information about the filer and the foreign partnership. In addition, there are several schedules that you may need to fill out, depending on your filing category. These include:

- Schedule A – Constructive Ownership of Partnership Interest

- Schedule B – Income Statement—Trade or Business Income

- Schedule D – Capital Gains and Losses

- Schedule G – Statement of Application of the Gain Deferral Method Under Section 721

- Schedule H – Acceleration Events and Exceptions Reporting Relating to Gain Deferral Method Under Section 721(c)

- Schedule K – Partners’ Distributive Share Items

- Schedule L – Balance Sheets per Books

- Schedule M – Balance Sheets for Interest Allocation

- Schedule N – Transactions Between Controlled Foreign Partnership and Partners or Other Related Entities

- Schedule O – Transfer of Property to a Foreign Partnership

- Schedule P – Acquisitions, Dispositions, and Changes of Interests in a Foreign Partnership

These are the most common schedules associated with Form 8865. Depending on your specific circumstances, you may need to include additional schedules. It’s important to review the IRS instructions or work with an offshore tax professional to determine your individual reporting requirements.

Form 8865 Penalties: What Happens If You Don’t File?

The penalties for failing to file Form 8865 are substantial and can escalate quickly. The initial fine is $10,000 for each year the form is not filed. However, if the IRS sends a notice of the filing obligation, and non-compliance continues for more than 90 days, then an additional penalty of $10,000 applies for each 30-day period. This goes up to a maximum of $50,000 per return.

Moreover, there are penalties related to the accuracy of the information provided. The IRS can assess a 40% penalty on unreported or underreported income.

Need Help Filing Form 8865 and its Schedules? Gordon Law Makes it Easy

At Gordon Law, we understand that dealing with Form 8865 can be overwhelming. That’s why we’re dedicated to making the filing process simple and stress-free for you.

Our team, highly experienced in international tax law, will guide you through every step, ensuring your filing is accurate and complete. We’ll help you navigate the complexities of Form 8865 with ease, giving you the ultimate peace of mind.