Staking cryptocurrency is a popular way to earn extra income from your digital assets, but many investors face an unpleasant surprise at tax time when they realize those staking rewards are taxable.

At Gordon Law Group, we’ve helped more than 1,000 investors file their crypto taxes with confidence. We’re here to guide you through the IRS maze!

In this article, we’ll walk you through how crypto staking taxes work and how to report staking rewards on your tax return. Let’s dive in.

Is Crypto Staking Taxable?

Yes, crypto staking is taxable in the United States. When you stake your cryptocurrency, you are essentially locking up your crypto assets to support a network’s operations. In return, you earn staking rewards. The IRS considers these rewards as taxable income, and they must be reported on your tax return.

How Are Crypto Staking Rewards Taxed?

Generally, staking rewards are taxed as ordinary income. This means that they’re taxable as soon as you have “dominion and control” over them, and the amount of income is based on the fair market value at time of receipt.

However, the term “staking” can actually refer to very different types of activities, so the taxation of staking rewards depends on your specific circumstances.

Taxes on Proof of Stake Rewards

Proof of Stake (PoS) rewards refer to the cryptocurrency awarded for maintaining a particular blockchain. These rewards are considered income at the time they are received. This income must be reported on your tax return, and it is subject to federal income tax.

In some cases, Proof of Stake rewards are locked up for a set period of time (when directly staking ETH2, for example). In Rev. Rul. 2023-14, the IRS clarifies that these rewards are not taxable until you have “dominion and control” over them—in other words, when you have the freedom to withdraw the coins and trade them.

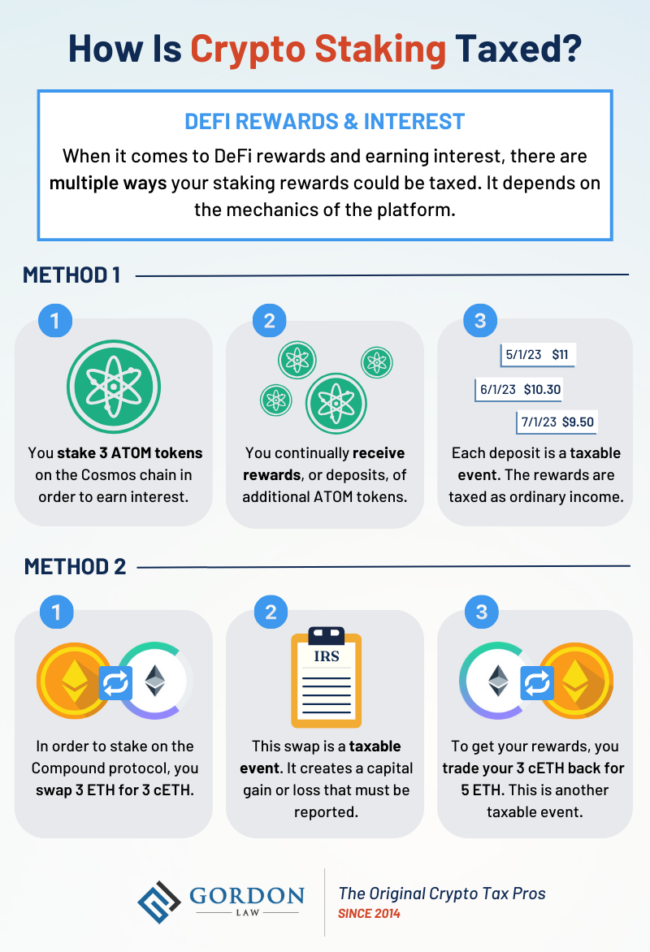

Taxes on DeFi Staking Rewards and Crypto Interest

Staking rewards can refer to the interest earned through DeFi lending and putting crypto into a liquidity pool. There are multiple ways these rewards can be taxed, depending on the mechanics of your DeFi platform. Let’s take a look at some common examples of crypto staking taxes in DeFi.

1. Earning More of the Same Token

Maria participates in a DeFi chain called Cosmos, where she stakes 3 ATOM tokens. As long as she keeps those 3 tokens staked, she receives regular deposits of additional ATOM in her wallet. Each deposit is taxable as ordinary income.

2. Using Protocol or Placeholder Tokens

Bob decides to use Compound, a popular DeFi exchange, to earn interest on his crypto. He deposits 3 ETH into the Compound liquidity pool, and he receives 3 cETH in exchange. This is a taxable cryptocurrency swap, triggering a capital gain.

A few months later, Bob is ready to withdraw his initial deposit and the interest earned. His 3 cETH are now worth 5 ETH. By converting back to ETH, Bob has another taxable event and a capital gain.

Taxes on NFT Staking Rewards

If you earn rewards from staking non-fungible tokens (NFTs), these rewards are also considered taxable income. The value of the rewards should be reported as income based on their fair market value at the time of receipt.

What Are the IRS Rules About Crypto Staking Taxes?

While the IRS is slow to release specific guidance about cryptocurrency, it has clarified its stance on staking rewards in Rev. Rul. 2023-14. Here’s what you need to know:

- Staking rewards are taxable as ordinary income at the time of receipt. This is when you have “dominion and control” over the assets—in other words, you can freely move, spend, or trade the coins.

- To calculate your staking income, determine the fair market value of the coin at the time of receipt. This must be done for each individual deposit.

- When you sell or dispose of cryptocurrency earned through staking, you’ll trigger a capital gain or capital loss. The cost basis, used for calculating capital gains, is the amount that was initially reported as income.

Didn’t the IRS Say That Staking Rewards Aren’t Taxable Until They’re Sold?

No, this is a common misconception. Back in 2022, there was a highly publicized case in U.S. Tax Court centered around when staking rewards should be taxed.

The couple in question argued that taxes shouldn’t apply until the staking rewards are sold, and the IRS issued the couple a tax refund. However, this case had no effect on U.S. tax law.

Can I Write Off Staking Expenses?

Yes, you may be able to write off certain expenses associated with crypto staking, including hardware, electricity, and fees. However, keep in mind that the IRS typically classifies staking as a hobby rather than a business. This means you can only claim expenses up to the amount of income earned from staking.

How to Report Staking Rewards on Taxes

Reporting staking rewards on your taxes is essential for complying with IRS rules and avoiding penalties. Follow these steps to report your rewards:

- Gather Your Crypto Tax Documents: Collect all records related to your staking rewards and other crypto transactions. Many cryptocurrency exchanges report staking rewards on Form 1099-MISC, so be sure to download these forms if you receive them. You should also download your full transaction history from each exchange, wallet, or account you used during the year.

- Report Ordinary Income: Staking rewards and other forms of ordinary income can be reported on Schedule 1 of Form 1040.

- Calculate Your Gains and Losses and Complete Form 8949: For each transaction, calculate the capital gain or loss, then use this information to complete Form 8949. This process can be very challenging because most crypto tax software doesn’t handle DeFi correctly. Consider hiring a crypto CPA for an easy, accurate report.

- Transfer Totals to Schedule D: Once you’ve finished Form 8949, add the totals from each section to Schedule D. This is where you summarize your capital gains and losses.

- File and Pay: After completing the rest of your tax return, file and pay before the deadline to avoid tax penalties.

Ready to Get Started?

Contact Gordon Law Group today to ensure that your crypto staking activities are accurately reported, minimizing your tax bill and helping you stay on the right side of the law. Don’t navigate the complex world of crypto taxes alone; we’re here to help you file with confidence!