Update August 25, 2023: This article was originally published on November 3, 2022. Read our post on IRS Form 1099-DA for more up-to-date information.

The new Infrastructure and Investment Jobs Act, which was signed into law November 15, 2021, means big change for cryptocurrency tax reporting.

This law, previously referred to as the infrastructure bill, will give the IRS more tools to enforce cryptocurrency tax requirements. It could also cause the DeFi ecosystem to implode within the U.S., depending on how the U.S. Department of the Treasury ends up translating the law into the United States Tax Code.

- Cryptocurrency “brokers,” including exchanges and some wallets, will have to report customers’ activity to the IRS each year using Form 1099-B.

- Exchanges will need to increase KYC (know your customer) practices and collect more identifying information from users.

- When you receive $10,000 in crypto, the transaction will trigger a reporting requirement.

Let’s break down these upcoming changes to crypto tax reporting.

Why is cryptocurrency involved in an infrastructure package?

The Bipartisan Infrastructure and Investment Jobs Act promotes investment in America’s roads, public transit, water, clean energy, and more. But to get it passed, lawmakers had to include provisions to pay for any new spending. Cracking down on cryptocurrency tax evasion and underreporting is one way of raising the necessary funds.

Cryptocurrency brokers will need to issue Form 1099-B reporting customers’ activity

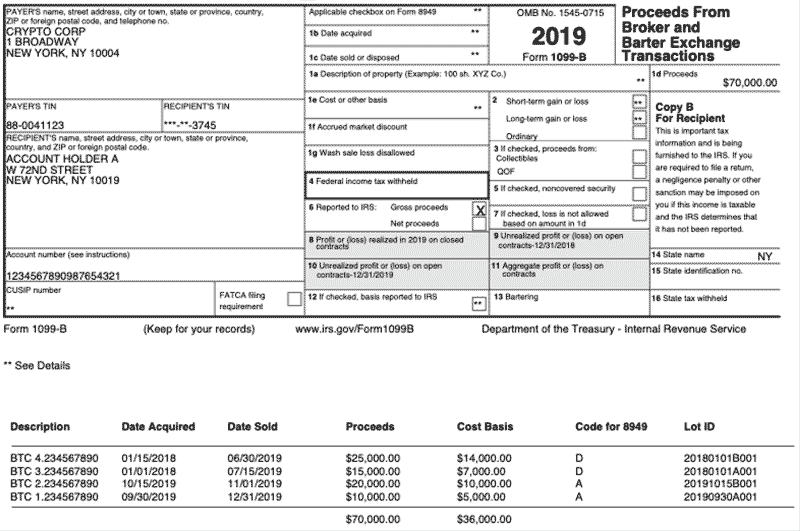

The law will require all cryptocurrency “brokers”—exchanges, some wallets, and possibly others—to send an annual information return called 1099-B to customers and the IRS. You might recognize Form 1099-B if you use a brokerage account for stocks.

If you followed the infrastructure bill’s controversial journey through Congress, then you know the new definition of “broker” has been hotly contested. Find more on that below.

Since cryptocurrency is treated as property for tax purposes, transactions like selling crypto for fiat, exchanging one type of crypto token for another, and using crypto to purchase goods or services are all taxable transactions. Each one is considered a “sale” or disposition of the crypto asset*, which creates either a capital gain or a capital loss. Total gains or losses must be calculated for the tax year.

*A crypto asset can be a cryptocurrency token (for example, ETH), part of a cryptocurrency token (0.001 ETH), an NFT, or a utility token.

Form 1099-B, Proceeds from Broker and Barter Exchange, reports the following information for each sale or disposition of a cryptocurrency asset:

- Date you initially acquired the asset

- How much you initially spent on the asset (cost basis)

- Date you sold or disposed of the asset

- How much you “sold” the asset for (sales proceeds)

The law requires brokers to issue these forms annually beginning in 2024. The form reports the prior year’s transactions, so understand that your crypto transactions will certainly be tracked beginning on January 1, 2023.

We expect some cryptocurrency brokers will begin issuing the form earlier, while others will hold out as long as possible in order to protect users’ privacy.

Challenges for exchanges issuing Form 1099-B

Historically, creating accurate cryptocurrency tax reports has been a challenge because exchanges and wallets don’t share information about the acquisition date or cost basis of an asset. As you move cryptocurrency tokens from one place to another, that information gets lost. Crypto tax software can help with this problem, but a lot of manual work can also be required to reconcile the data.

Now, however, the Infrastructure and Investment Jobs Act requires that cryptocurrency brokers pass this information to each other as crypto assets are transferred. This will certainly make tax reporting easier for customers, since they’ll be provided more of the information they need to complete a crypto tax return.

However, you may still find some gaps on Form 1099-B since there are many situations where getting the right information will be a challenge for brokers.

For example, some cryptocurrency enthusiasts are calling for DeFi exchanges to be excluded from the definition of “broker.” In that case, these exchanges would not be required to pass along any information about acquisition date and cost basis.

Cold wallets, too, would likely not be considered brokers. Sending crypto to a cold wallet and then back to a broker could cause data to be lost.

It’s also unclear how brokers will be expected to deal with missing information from coins acquired prior to 2023.

Cryptocurrency brokers will have to collect customers’ personal information

In order to issue the required tax forms, cryptocurrency brokers will need to collect their customers’ personal information, such as full name, address, and Social Security Number.

This presents a fundamental threat to the DeFi and NFT ecosystems, where anonymity is central to the concept for many users. Some innovators in this space may choose to move out of the U.S. and/or stop offering their service to U.S. customers to avoid expensive compliance requirements.

Controversy over who is a cryptocurrency “broker”

There has been hot debate over the language in the original bill, which critics say defines “brokers” too broadly. Under the original language, miners, node operators, and others who help maintain blockchains are defined as “brokers”—but they would be unable to provide the information returns that would be required under law.

Proposed amendments to clarify this language were rejected and the bill passed both chambers of Congress with its original language.

The Department of the Treasury will ultimately be responsible for interpreting the law and writing it into the United States Tax Code. The IRS has said that it won’t target non-brokers, but it’s impossible to know for sure until modifications to the Tax Code are proposed.

Hopefully, the language that has sparked so much debate and creates impossible standards for non-brokers will be modified along the way.

However, true brokers—namely, cryptocurrency exchanges or wallets where users can buy, sell, trade, stake, send, and receive cryptocurrency—should plan to implement the required information returns after December 31, 2023.

Receipt of digital assets worth $10,000 or more will need to be reported

The Infrastructure and Investment Jobs Act also includes an amendment to the Tax Code which would require anyone, whether an individual or a business, to report the receipt of digital assets worth $10,000 or more within 15 days. The required form includes the sender’s Social Security Number and other personal information. This rule already exists for cash transactions.

A research report by attorney Abraham Sutherland, published by Proof of Stake Alliance, breaks down the details of what this means and why it’s such a bad idea to copy-and-paste this regulation onto digital asset transactions—including the sheer impossibility of compliance in many situations.

Like the new definition of a “broker,” this provision will also need to be written into the United States Tax Code by the Department of the Treasury, and it will ultimately be up to them how to write this rule.

Need help with crypto taxes?

Call the cryptocurrency tax attorneys at Gordon Law Group! We’ve been preparing crypto tax returns since 2014, and our dedicated team knows the ins and outs of this ever-changing field.

If you want to rest easy knowing your cryptocurrency tax return is fully accurate while saving as much money as possible, don’t wait; contact us today!