Opening your mailbox to find IRS Notice CP14—or any letter from the IRS demanding payment—is enough to make most people start losing sleep. Just keep in mind that you’re not alone, and this notice isn’t the end of the world. Since it’s typically the first notice of tax debt you’ll receive, you still have plenty of time to resolve the issue!

Gordon Law is an experienced tax law firm that’s resolved millions of dollars in tax debt since 2012. We help people like you protect their rights and understand their options when dealing with IRS debt.

In this article, we’ll break down IRS Notice CP14, explain why you might have received it, and guide you through the next steps.

What is IRS Notice CP14?

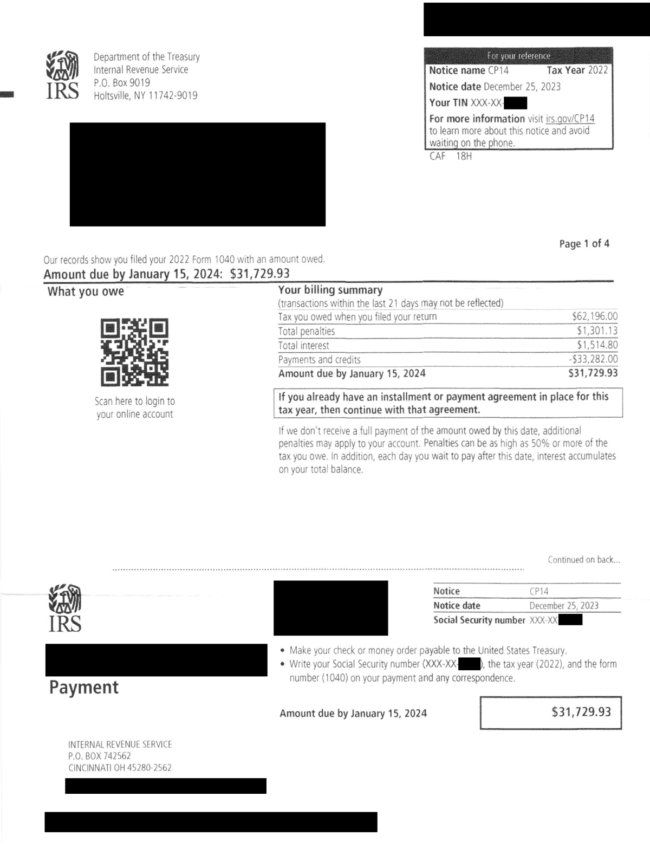

IRS Notice CP14 (Balance Due, No Math Error) is an initial notice sent by the IRS to indicate that you have unpaid tax debt. It details what you owe, including outstanding tax, penalties, and interest, and requests payment by a certain date.

CP14 Deadline:

- If you owe less than $100,000, you’ll have 21 days to respond to IRS Notice CP14.

- If you owe $100,000 or more, you’ll have 10 days to respond to the notice.

Is a CP14 notice bad?

A CP14 letter is the first of several notices sent by the IRS to collect what you owe. If you receive this notice, it’s important to address the issue quickly to avoid further penalties and interest. After 60 days, the IRS can begin collection activity.

Why did I receive a CP14 notice?

Typically, IRS Notice CP14 means that you have unpaid taxes, penalties, or interest. There are a few reasons you might receive this payment letter from the IRS:

- You filed your tax return, but didn’t pay the full balance due. This is the most common reason for the IRS to send a CP14 notice.

- You filed your tax return after the deadline. If you filed your tax return late, you may have penalties for late filing and late payment. Even if you paid your taxes in full, you could receive IRS Notice CP14 because of unpaid penalties and interest.

- You didn’t pay quarterly estimated taxes. If you owed more than $1,000 the previous tax year, then you’re required to make estimated tax payments each quarter. This is common for self-employed individuals and investors. You may have paid your taxes in full, but you could still have unpaid penalties and interest.

- The IRS sent a notice by mistake. Believe it or not, the IRS can make mistakes. The IRS may not have processed your payment yet; you may have submitted payment after the notice was already mailed, but before you received it; or there could be an error in the IRS system.

What to do if you receive IRS Notice CP14

If you receive IRS Notice CP14, make sure you pay attention to the deadline to respond. If you agree with the amount owed, you can either pay the balance in full or negotiate with the IRS to make a payment plan. You can also dispute the notice.

Remember, you have the right to hire a professional. Whether you need help understanding what this notice means or you want to dispute the amount owed, Gordon Law is here to guide you through.

Pro Tip: IRS penalties and interest will continue to add up over time, and this can quickly turn your tax debt into an unmanageable and overwhelming mess. The sooner you act, the fewer penalties you’ll face and the more options you’ll have to resolve the debt!

Keep the notice

It’s always best to hold onto any notices you receive from the IRS—especially if you disagree with what it says. Your IRS CP14 notice will contain important information like your response deadline, where to mail checks, and the phone number to call if you need to dispute the notice.

If you seek professional help from your CPA or a local tax attorney, it’s always helpful to have a copy of the original notice.

Check for mistakes

Make sure the information on the notice is correct, especially if you already paid your taxes.

- Check the amount: The “Billing” section toward the top of the notice breaks down the amount of tax owed, along with any penalties and interest charged. Make sure the amount of tax matches what you filed.

- Check your payment status: The IRS can have delays with processing payments, especially those sent by mail. If it’s been at least 2 weeks, you can call the IRS at 800-829-1040 to check the status of your payment. If you used IRS Direct Pay, you can check your online account 2 business days after the scheduled payment date.

- Check the IRS newsroom: Sometimes, the IRS makes errors in bulk. You may be able to find information about known issues on irs.gov/newsroom.

How to respond if you agree with the amount owed:

If you agree with the amount on your CP14 notice, simply pay in full by the deadline stated on your notice.

- Pay online: Make a payment online at irs.gov/payments. Your notice may contain a QR code with a payment link.

- Pay by check: Check your notice for the correct IRS payment address—it may vary based on your location. Include the payment slip from the bottom of the first page of your notice. Read the instructions on the notice carefully before sending your payment.

How to pay off CP14 if you can’t pay in full:

If you received a CP14 notice from the IRS and you can’t pay in full by the deadline, it’s still important to take action. Believe it or not, the IRS is usually willing to work with taxpayers. You have several options to help ease the burden of unpaid taxes.

- See if you qualify for reduced tax debt: A program known as IRS Offer in Compromise can significantly reduce the debt of qualifying taxpayers. Some of our clients have eliminated $500,000 of IRS debt or more using an OIC! The requirements are strict, so it’s best to consult an experienced tax professional before you apply.

- Press pause on IRS collections: If you’re facing financial hardship, so that you can’t pay your tax bill and your basic living expenses at the same time, you may qualify for Currently Non Collectible (CNC) status. This can provide relief for up to 2 years, wherein the IRS typically won’t pursue aggressive collection activities such as liens or levies. You may need to file past due tax returns before the IRS will agree to grant CNC status. Call our tax attorneys at (847) 580-1279 if you need help.

- Arrange an IRS payment plan: The IRS offers several options for payment plans, allowing you to pay off your debt over time (up to 72 months, or 6 years). You can apply online if you owe $100,000 or less. However, you may want to speak to a tax attorney first to make sure this is the best option for your case.

- Make a partial payment: Even if you can’t pay the full amount now, a partial payment will reduce the amount of penalties and interest you owe in the long run.

- Speak with a professional: If your tax debt is $20,000 or more, it’s a good idea to contact a tax debt attorney. Many firms, including Gordon Law, offer free consultations. This way, you can ensure you don’t miss out on any potential options to resolve your tax debt.

How to dispute IRS Notice CP14:

If you disagree with your CP14 letter for any reason, don’t ignore it. IRS Notice CP14 comes early in the collections process, so you have plenty of time to make your case, but it’s important to respond by the deadline.

- Call the IRS: Your notice will contain instructions for what to do if you disagree with your notice, including the right phone number to call. Before you call, gather any documents that support your side of the story. It can be difficult to reach the IRS over the phone, so be prepared to wait a while.

- Contact the IRS Taxpayer Advocate Service: For tax debts under $20,000, consider calling the IRS Taxpayer Advocate Service. This is a free service operated by an independent branch of the IRS.

- Hire a tax attorney: If your tax debt is over $20,000, an experienced tax debt lawyer can help you arrange a favorable payment plan, handle all IRS communications, and even potentially reduce what you owe to the IRS. At Gordon Law, we’ve helped hundreds of taxpayers resolve their tax debt and get their lives back. Call (847) 580-1279 today for a free consultation.

What happens after an IRS CP14 notice?

If you don’t respond to IRS Notice CP14 by the deadline, you will continue receiving notices from the IRS until the balance is paid in full. You may receive IRS Notice CP501, followed by IRS Notice CP503.

Eventually, you may receive an IRS lien or a notice of intent to levy. If you have unpaid tax debt, the IRS has the power to:

- Withhold future tax refunds

- Place a lien on your home or other assets—and eventually seize the assets if you don’t pay

- Suspend your passport renewal

- Garnish your paychecks

- Take money straight from your bank account

You can avoid these unfortunate scenarios by responding to IRS Notice CP14 in a timely manner.

Need help with your IRS payment letter? Speak with a lawyer

At Gordon Law, we’ve helped thousands of taxpayers fight back against IRS debt, including IRS Notice CP14. Our highly experienced Chicago tax attorneys are here to guide you through your options and help you find the best path forward. We’ve helped countless clients reduce their debt by $100,000 or more!

If you need help understanding your IRS notice, disputing a notice, or resolving your tax debt, don’t hesitate to reach out. .

Get in touch today and free yourself from the stress of tax debt!