The increased efforts of the IRS to collect taxes on cryptocurrency transactions has left many wondering how to avoid crypto taxes. For some individuals and businesses, Puerto Rico could be the crypto tax haven you’ve been searching for.

A law known as Act 60 makes Puerto Rico taxes very favorable to crypto investors. This tax haven can easily save taxpayers hundreds of thousands of dollars per year (or more) in federal taxes!

At Gordon Law, we’re committed to helping crypto investors thrive with top-tier legal and tax support. We’ve helped several taxpayers take advantage of Puerto Rico Act 60, and we’ve saved our clients millions of dollars in cryptocurrency taxes and penalties.

In this post, we’ll help you understand whether the Puerto Rico crypto tax haven is the right choice for you and how to unlock Act 60 tax savings.

Puerto Rico Capital Gains & Act 60

Puerto Rico’s Act 60 promotes investment in Puerto Rico through tax incentives. These tax benefits include zero tax on passive income, including capital gains, dividends, and interest.

Other tax benefits from Act 60 include:

- 2-4% corporate tax

- 4% income tax

- 75% tax exemption on state property taxes

- 50% tax exemption on municipal taxes

These benefits can be achieved while maintaining U.S. citizenship, whereas other crypto tax havens like Singapore, Germany, Malta, and others require giving up your U.S. citizenship.

Puerto Rico is a U.S. territory that operates like a state, but with more independence to create its own tax laws.

Act 60 combines the tax benefits from 2 previous acts—Puerto Rico Act 20 (Export Services Act) and Puerto Rico Act 22 (Individual Investors Act)—which were initially enacted in 2012. Act 60 also updated the requirements to qualify for this favorable tax treatment.

Who Should Consider Using Puerto Rico Act 60?

You may be a good candidate to use Puerto Rico as a crypto tax haven if you pay more than $15,000 in U.S. taxes per year, anticipate high capital gains in the future, and want to retain U.S. citizenship. You must also be willing to move your life to Puerto Rico for at least 3 years (more on that below).

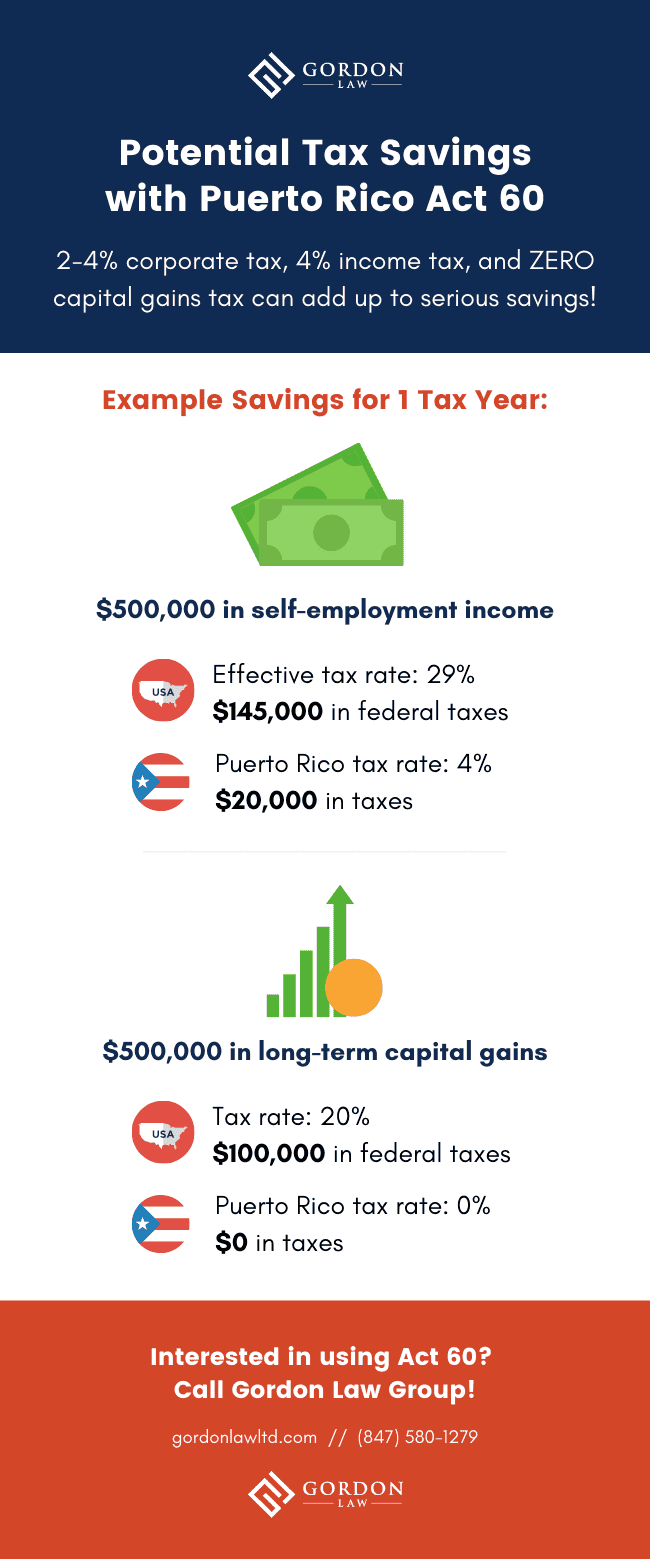

Let’s Break Down the Tax Savings with Act 60: Why Puerto Rico is the Perfect Crypto Tax Haven

Zero Capital Gains Tax:

Cryptocurrency is a capital asset. This means that any disposition of crypto—including trading one type of coin for another—is a taxable event. Learn more about how capital gains from cryptocurrency are taxed in our FAQ.

However, when taking advantage of Act 60, capital gains are not taxed at all. The potential savings for active cryptocurrency investors or traders are enormous!

For example, say you have $100,000 in capital gains from crypto. In Puerto Rico, you would pay $0 in capital gains tax on those profits—whereas in the U.S., you’d be required to pay $20,000 in federal capital gains taxes!

Income Tax:

Certain business owners or freelancers (who we’ll refer to collectively as self-employed workers) can also enjoy significant savings on income taxes with the right setup in Puerto Rico. By setting up a local corporation, you can take out dividends tax-free, since those are considered passive income. Regular income is taxed at only 4%.

Someone who makes $500,000 in self-employment income could easily save over $100,000 per year in federal income taxes alone.

Together, Puerto Rico’s low corporate and income tax rates combined with state and local tax exemptions allow your tax savings to soar!

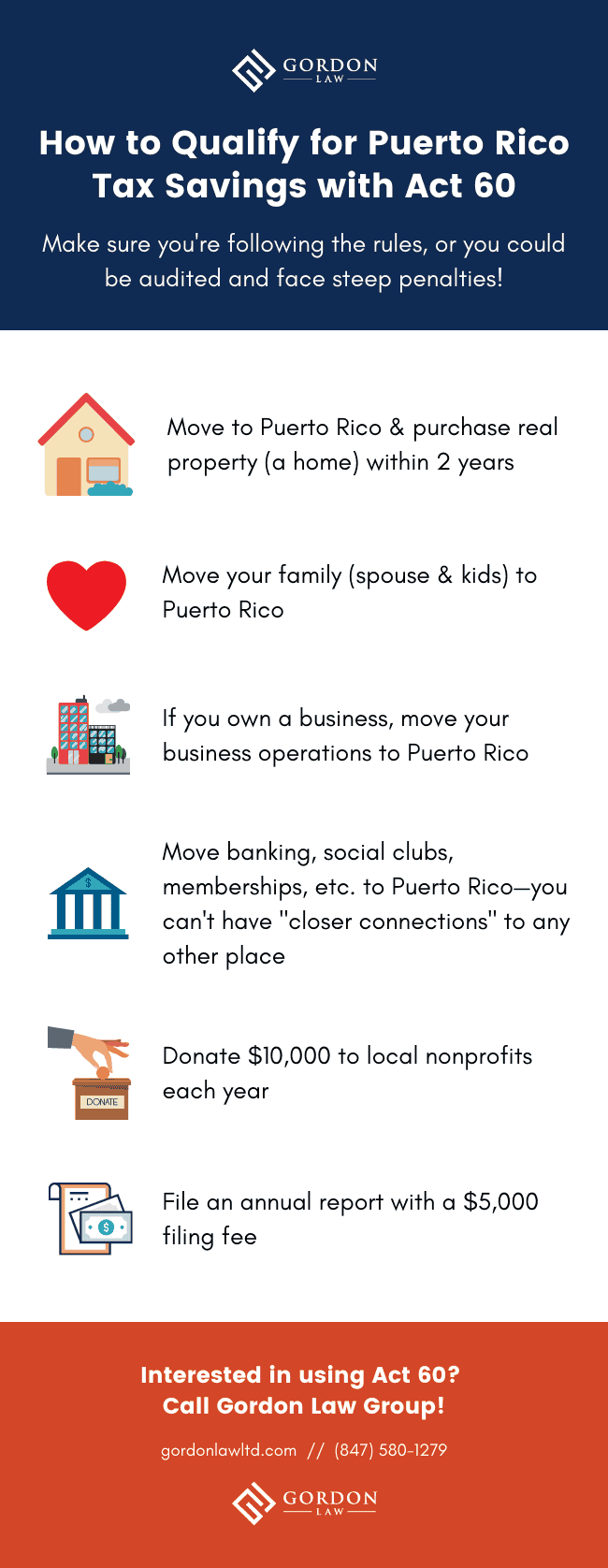

How to Qualify for Act 60 & Save on Crypto Taxes

To take advantage of Puerto Rico crypto tax savings, you must meet these requirements:

- You must move to the territory and meet the physical presence test each year that you wish to take advantage of Act 60 tax savings.

- Option 1: Must be present for at least 183 days during the tax year (these days don’t have to be consecutive)

- Option 2: Must be present for at least 549 days during the tax year + the 2 preceding years (at least 60 days each year)

- You must purchase real property there within 2 years; this property must be used as your permanent residence.

- You must not have been a resident of Puerto Rico in the past 10 years.

- You must move your whole life—your family, business, banking, and social ties—to Puerto Rico. You cannot have “closer connections” to any other place.

- For business owners, you must have a bona fide office or establishment in Puerto Rico and register there.

- If you have employees in the U.S., it may create additional tax liability and disclosure requirements.

- You must make an annual donation of $10,000 to local nonprofits (that you don’t control). 50% of the donation must go to organizations working to end child poverty.

By taking these steps to capitalize on Puerto Rico crypto taxes, you will satisfy the physical presence test, make Puerto Rico your tax home, and establish your closest connections to Puerto Rico.

Important Considerations for the Puerto Rico Crypto Tax Haven

The tax benefits of Act 60 only apply to Puerto Rico-sourced income. Thus, 0% tax on capital gains will only apply to the capital gains incurred after you move to Puerto Rico. Any capital gains incurred before you move there will still be subject to U.S. tax treatment. You may want to sell your crypto and re-buy it once you are in Puerto Rico.

However, if you wait to realize your capital gains until you’ve been a resident of Puerto Rico for 10 years, you can receive a 5% reduction in capital gains tax.

The governing law extends the benefits of Act 60 through 2035.

Keep in mind that there may be additional taxes in Puerto Rico that you wouldn’t have otherwise (although these are typically vastly outweighed by the tax benefits).

For business owners, there are corporate municipal taxes, up to 0.5% of gross income. There is also a personal property tax on business assets; the average rate is 10% of the net book value of equipment, furniture, and fixtures used by the business. The rate varies by municipality.

Lastly, if the IRS selects you for a tax audit and determines that you are not eligible to benefit from the Puerto Rico crypto tax haven, you are at risk of owing a substantial amount. This amount would be the sum of all the taxes you’ve saved, plus interest compounded daily from the date the tax was due. You would be subject to penalties up to 25% of the amount saved, or even more if the underreported income is attributed to fraud.

To avoid these types of penalties, you should be sure to use an experienced professional to help you take advantage of Act 60.

Ready to Move to Puerto Rico? We Can Help!

If you’re ready to stop paying capital gains tax and start living your best life on the sunny island of Puerto Rico, don’t wait—contact us today!

Our cryptocurrency tax lawyers have helped many people take advantage of Act 60. We’ll make sure you do it right and enjoy maximum tax savings. Give us a call at (847) 580-1279 or contact us online to get started.

Sources: