Are you looking to set up your own business? Then chances are you will have come across the buzzword “pass-through taxation.” But what exactly does this phrase mean, and why is it important?

Each type of business entity comes with different tax structures. Let’s explore what these entities are and learn how pass-through taxation works.

What Are Pass-Through Taxation and Pass-Through Income?

Before we get into the nitty-gritty of its tax benefits, let us first define pass-through income.

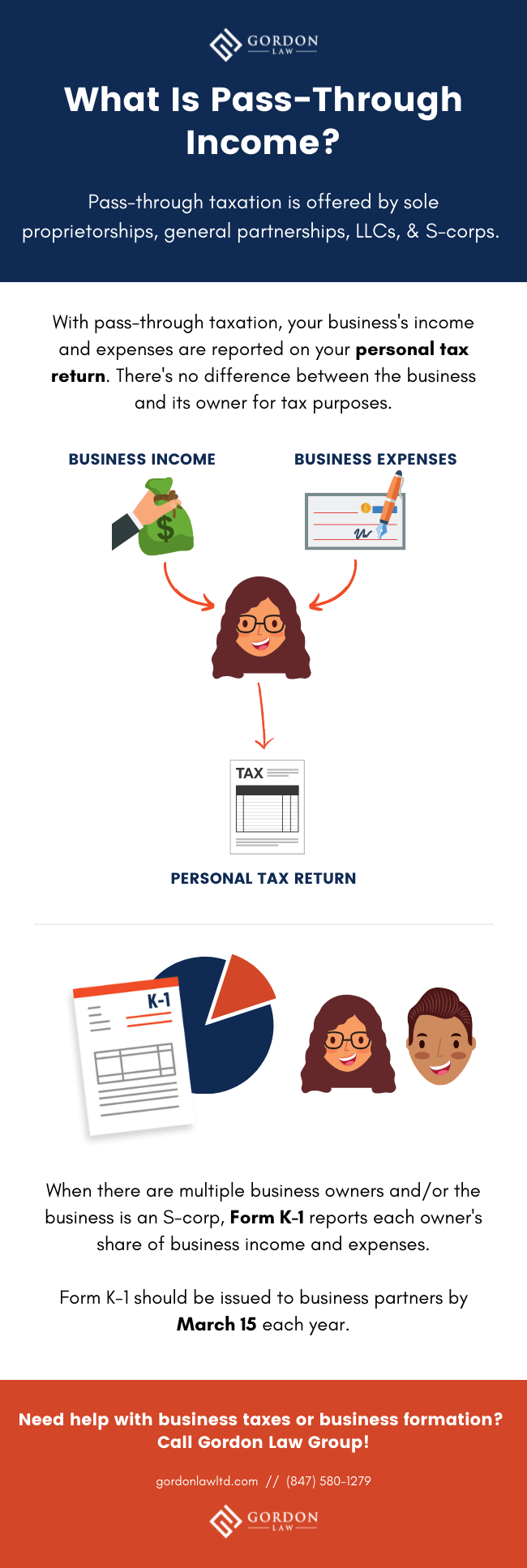

As the name suggests, pass-through income is business revenue that passes straight down to you and any other business owners. The net income includes all the profits and losses the business incurs.

Corporations, on the other hand, are taxed at the entity level before income is distributed to the owners.

With pass-through income, your individual income tax returns reflect your share of the company’s profits and losses.

What is a Pass-Through Entity?

A pass-through entity is also called a flow-through or fiscally transparent entity. Such a business structure allows the benefit of pass-through income. Some of the most common pass-through entities are:

- Limited Liability Companies (LLCs)

- Partnerships

- S-corps

- Sole proprietorships

So, to get the benefits of pass-through income, you need to establish one of the pass-through entities above. But, keep in mind these structures operate very differently from each other in various aspects.

But out of all the structures above, LLCs are perhaps the most flexible. An LLC can even choose to be taxed as an S-corp or C-corp.

How to Report Pass-Through Income on Your Tax Return

When you look at the IRS’s complicated rules for tax calculation, it’s easy to get confused. Where this income is reported depends on the type of pass-through business structure.

For sole proprietorships or single-owner LLCs that do not make a special tax election, pass-through income is typically reported on Schedule C of your personal tax return.

Record your business’s revenue and deductible business expenses on Schedule C; good bookkeeping throughout the year will help streamline this process.

If the business has multiple owners or is taxed as an S-corp, each owner will likely receive Form K-1 reporting their share of the profits and losses. This information can easily be plugged into Schedule E on your tax return.

Benefits of Pass-Through Taxation

Pass-through taxation offers many benefits for business owners.

First, pass-through businesses are not subject to the C-corp double taxation.

The simplicity of a pass-through business structure lets owners combine their business and personal income for tax purposes. That is especially beneficial for streamlining operations as a small business or startup.

Reporting losses on your personal tax return can provide a greater tax benefit than other tax setups, especially in a business’s early years.

In some cases, pass-through businesses now allow you to subtract 20% of the company’s qualified business income (QBI) from your tax return. This is a relatively new development thanks to the Tax Cuts and Jobs Act of 2017.

How to Convert a C-corp to a Pass-Through Entity

Are you a C-corp owner looking to save on taxes? The good news is that you can convert to a pass-through status any day. In just a few legal steps, you can become the proud owner of a different business entity. There are two pathways you can take to achieve this:

- Convert your C-corp to an LLC

- Convert your C-corp to an S-corp

Whichever you choose, you will get the end result of pass-through income. But, converting to an LLC generally takes longer and is a little more complicated. Converting to an S-corp, on the other hand, is the simplest, most cost-effective method.

That said, you need to keep in mind that S-corps don’t work for every business. Check out our guide to LLCs vs. S-corps vs. C-corps for some pros and cons.

Launching a pass-through entity can require a lot of legal paperwork in the process. And forgetting a step can lead to a lot of unnecessary delays. Do you want to set up your business without delays? Then be sure to call Gordon Law Group’s award-winning attorneys to help!

Sources: