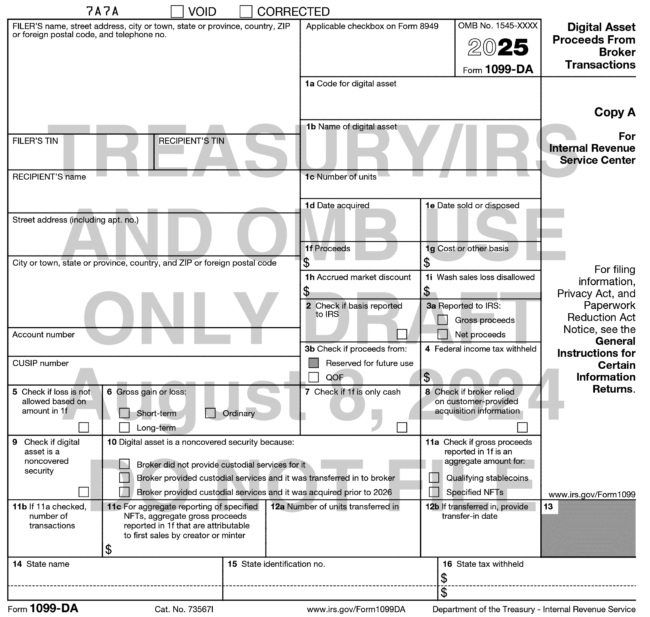

Last week, the IRS issued a revised draft of the much-anticipated Form 1099-DA, a significant step toward the agency’s efforts to regulate the reporting of digital asset transactions. Officially named “Digital Asset Proceeds From Broker Transactions,” this form outlines how brokers will need to report sales and exchanges of digital assets starting in 2025.

So, what’s new, what remains unchanged, and what still needs to be clarified? Here’s an overview based on the latest draft, along with insights from our experienced crypto tax attorneys.

What’s new in the updated Form 1099-DA?

The IRS has made several modifications to the form, addressing feedback from crypto tax professionals. Some of the key changes include:

- Removal of the “Explanation if no recipient TIN” Box: The IRS has eliminated the confusing box that required brokers to explain why a recipient’s Taxpayer Identification Number (TIN) was not provided.

- Consolidation of Non-Cash Proceeds Reporting: Previously, the form required detailed categorization of non-cash proceeds. In the new draft, Boxes 7a, 7b, and 8 have been merged into a single Box 7, simplifying the reporting process.

- New Box for Broker Reliance on Customer Information: Box 8 now asks brokers to confirm if they relied on customer-provided information when preparing the form. This could become a focal point during audits, potentially influencing penalty relief decisions.

- Specific Reporting for Stablecoins and NFTs: Boxes 11a and 11b now allow for the reporting of qualifying stablecoins and specified NFTs, respectively. Additionally, Box 11c has been introduced to differentiate between ordinary income from the sale of original NFTs and the capital gains earned from selling, trading, or disposing of NFTs.

- Elimination of Certain Transaction Details: The IRS has removed boxes that previously solicited information on the time of acquisition, time of sale, digital asset address, and transaction IDs, reflecting a shift toward streamlining the reporting requirements.

What remains the same?

Despite the updates, some of the more ambiguous elements of the form persist:

- Box 5—Loss Disallowed: This box remains unchanged, still requiring brokers to indicate if a loss is not allowed based on the amount reported in Box 11. The precise meaning of this box remains unclear, and further guidance is expected.

- Box 10—Non-Covered Sales: Brokers must continue to provide a reason for classifying a sale as non-covered (meaning the cost basis does not need to be reported).

- This requirement surpasses what is currently required for Form 1099-B reporting, which is used for stocks.

- The options provided are limited. Notably, there’s no option to state that the broker did not receive a transfer statement from another broker—one of the allowable reasons previously stated by the IRS. Given how frequently traders move digital assets between different accounts, this is a large oversight.

Ongoing confusion and ambiguity as the clock ticks

While the updated draft of Form 1099-DA introduces some improvements, it leaves several questions unanswered. With just a few short months before the new requirements take effect, brokers are still in a challenging position, having to interpret the final regulations without comprehensive guidance from the IRS.

The IRS has indicated that draft instructions for filers will be released soon, with a 30-day comment period to follow. In the meantime, those with concerns about the draft form are encouraged to submit their feedback through the IRS’s forms and publications comments page.

Preparing for the new reporting requirements

With the reporting period set to begin next year, the clock is ticking for brokers to ensure their systems are ready to comply with the new requirements. The IRS’s evolving guidelines could impact the entire crypto industry, making it crucial to stay informed and prepared.

Need assistance with crypto reporting requirements?

Since 2014, Gordon Law has been at the forefront of cryptocurrency taxation, helping thousands of investors navigate their tax obligations. With extensive experience in crypto tax reporting and audit defense, we’re here to guide you through these complex changes.

Don’t wait for the IRS to catch up with you—contact us today for trusted legal advice. Let us help you manage your crypto tax responsibilities so you can focus on building your financial future with confidence.