Opened the mail to find an IRS CP503 Notice waiting for you? This is never a pleasant scenario—after all, no one wants letters from the IRS demanding payment!

Chances are, though, that the CP503 Notice won’t come as a surprise. It’s not the first letter that the IRS sends when you owe taxes. But that doesn’t make it any less stressful when it does land in your mailbox. So, to help, let us explain exactly what an IRS Notice CP503 means, why you received one, and your options for moving forward.

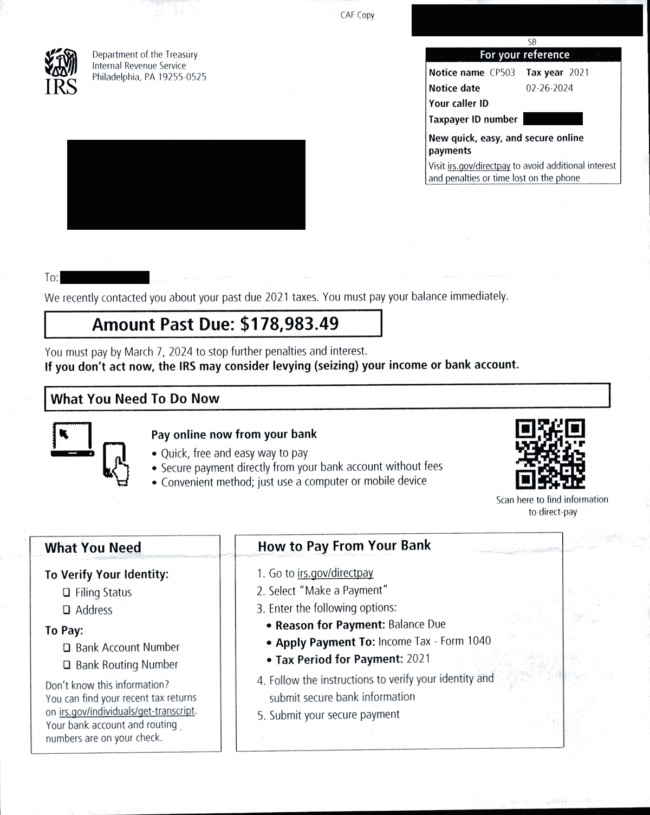

What is an IRS Notice CP503?

An IRS CP503 Notice is a reminder that you owe IRS taxes. It’s the third letter in a series of notices you might receive from the IRS in this order:

- IRS Notice CP14: Your first IRS notice to explain that you have unpaid tax debt. (This is only one of several notice types you may receive as the first alert.)

- IRS Notice CP501: The second IRS notice—but first reminder—that there is tax debt to pay.

- IRS Notice CP503: The second, and firmer, reminder letter from the IRS.

- IRS Notice CP504: A final reminder letter, after which point things can escalate.

The IRS CP503 is not a letter to ignore—we’ll cover how to respond below.

IRS CP503 Notice deadline

If you owe over $100,000, you only have 10 days to respond to an IRS CP503 Notice. But if you owe less than $100,000, you have 21 days to respond. The exact deadline will be stated on your notice.

What do these deadlines have in common? They’re quite short. You need to act quickly if the IRS sends you a tax debt letter. If you’re unsure where to start, reach out to us for help.

Why did I receive a CP503 Notice from the IRS?

You may receive an IRS CP503 Notice if you owe back taxes and:

- Haven’t responded to earlier notices

- Didn’t set up a payment plan or pay in full

Every IRS letter gets a little more urgent, so think of a CP503 Notice as a sign that things could escalate if you don’t respond.

What if I didn’t receive earlier notices?

Unfortunately, it’s hard to prove you didn’t receive earlier IRS ntices, such as an IRS CP14, IRS CP2000, or IRS CP501. If you can afford to pay, it’s best to settle the delinquent tax sooner rather than later. But if you can’t pay your tax debt, you still have options, which we’ll cover below.

What if I already paid the amount on the notice?

This is a common issue. It occurs because the IRS does not process payments right away. It can take days, or a few weeks, for the IRS to process your overdue tax payment.

The IRS CP503 Notice says, “If you already have an installment agreement or payment agreement in place for this tax year, then continue with that agreement.” Meaning, you can typically ignore the notice.

Still concerned? There’s no harm in giving the IRS a call to confirm you have made a payment or set up a different arrangement.

How to respond to a Notice CP503 from the IRS

Okay, so you have a Notice CP503 from the IRS, and you know you must respond. Where do you start, though? In all cases, your first steps should be as follows.

- Verify that the information, including the amount owed, is correct.

- Ensure that you understand what is required of you e.g. the payment deadline.

How you actually respond to your IRS CP503 Notice depends on two factors:

- Whether you agree with the amount allegedly owed; and

- If you can afford to pay the whole amount.

Let’s break down your options.

1. I agree with the IRS CP503 Notice and can pay in full

This one’s easy. If you can pay in full and you agree with the amount owed, simply use the envelope provided to mail a check to the IRS. Or pay online directly from your bank account, or by credit or debit card.

2. I agree with the CP503 IRS Notice but I can’t pay in full

You should still act. The IRS will typically work with taxpayers to agree on a reasonable payment plan based on how much you owe and your ability to pay. And in some scenarios, you may be able to reduce your overall tax debt or clear it entirely.

The most common options for managing tax debt after a CP503 Notice are:

- Make a partial payment: Can you afford to pay even some of the tax debt? Paying what you can afford can help you reduce the cost of your debt—such as interest and penalties—and it shows the IRS that you’re willing to do what you can to pay the back taxes.

- Seek an Offer in Compromise: An Offer in Compromise (OIC) means you arrange to pay less than you actually owe. However, you must be current with your tax returns and already be making payments toward the current year’s tax debts. The application is quite strict, involving precise calculations.

- Arrange a payment plan: Payment plans, such as IRS installment agreements, can help you make the debt more manageable by spreading out the payments. If you owe less than $100,000, you can apply online, or you may need to call the IRS.

- Claim financial hardship: If paying the debt could cause severe financial hardship, the IRS may accept that the debt is Currently Non Collectible (CNC). While the tax debt does not disappear, CNC status protects you from aggressive action such as IRS levies. You’ll need to prove that you can’t afford to pay living expenses and your tax debt at the same time.

In all cases, you should also strongly consider hiring a tax lawyer to help. Tax attorneys can explain your options so you can make an informed decision.

3. I don’t agree with the CP503 Notice from the IRS

You should act fast to dispute the amount owed (or whether you owe anything). There are three main ways to dispute an IRS CP503 Notice.

- Contact the IRS: Your IRS CP503 Notice will have a number to call if you want to dispute the debt. Gather any information you have to support your claim before you call, and be prepared to wait—you could be on hold a while.

- Call the IRS Taxpayer Advocate Service: This free service, operated by an independent branch of the IRS, can help you navigate your options.

- Hire a Tax Attorney: For debts over $20,000, it may be best to call a lawyer. In some cases, an experienced IRS lawyer can help you reduce what you owe, or at least arrange a suitable payment plan to help you manage your debt. At Gordon Law, our team has reduced tax debts by thousands or even millions of dollars.

Tips for handling IRS negotiations about your CP503 Notice

It’s always wise to consult an experienced tax lawyer, or tax advisor, before contacting the IRS. Not only will they help you make sense of your letter and what it means, but they can even handle negotiations for you!

However, if you choose to contact the IRS directly, here are some tips before you pick up the phone or apply for any payment plans online.

- Think about what you hope to achieve. Negotiations will feel less stressful if you know what outcome you’re hoping for, e.g. a payment plan.

- Know your rights. Remember, you do have the right to challenge an IRS CP503 Notice. Don’t let the IRS intimidate you into thinking you have no options!

- Be clear and honest about what you can afford to pay. Even if it is a relatively low amount, it’s better to ensure you can meet the terms of any agreement you make, rather than aiming too high and finding you can’t afford the payments down the line.

- Have your financial information ready to share. The more transparent you can be about your inability to pay, the more likely it is that the IRS will agree to a payment plan.

Don’t worry if the thought of IRS negotiations feels like too much to handle. That’s why we’re here to help. Contact Gordon Law at (847) 580-1279 to learn more about how we might assist.

What happens if I don’t respond to an IRS CP503 Notice?

Wondering what comes after IRS Notice CP503? Well, if you ignore an IRS CP503 Notice, there’s a good chance you will receive an IRS CP504 Notice. And this is where matters get serious.

A CP504 Notice is a “Notice of Intent to Levy.” A levy gives the IRS the right to seize your assets, such as bank accounts and wages, to cover the outstanding tax debt.

In other words, if you don’t pay the overdue tax in time, then the IRS could seize your property!

If you receive IRS Notice CP503, there’s still time to reach a payment agreement, but you need to act fast. Contact Gordon Law urgently to discuss your case and learn about your options.

Want to resolve your tax debt? Call our trusted attorneys

We know how overwhelming IRS tax debt can seem. However, the quicker you act, the easier it will be to resolve your tax debt once and for all.

You don’t need to face tax debt or IRS CP503 Notices alone. Instead, rely on Gordon Law. Our experienced attorneys have helped hundreds of clients respond to IRS notices, negotiate payment plans, and reduce their tax debt, often by millions of dollars. No matter how much you owe in back taxes, don’t panic! Let us review your situation and explain what options are available.

Our team offers free initial meetings with no obligation. So, you have nothing to lose by contacting Gordon Law to learn more about what your CP503 IRS Notice means and how to respond. Give us a call, or contact us online to get your finances back on track.