The IRS has been sending CP2000 crypto letters to virtual currency investors as part of the agency’s ongoing efforts to collect revenue from cryptocurrency taxes.

If you’ve received one of these letters, you may be scared and unsure of what to do next—especially if you know the amount of proposed tax due is wrong. But you don’t have to face this problem on your own! The crypto tax attorneys at Gordon Law have successfully fought many CP2000 bills. In this article, we’ll explain why you got this IRS notice, what it means, and what to do next.

What is the IRS CP2000 notice?

The CP2000 letter is not reserved for cryptocurrency traders; anyone with a discrepancy on their federal tax returns could receive the notice.

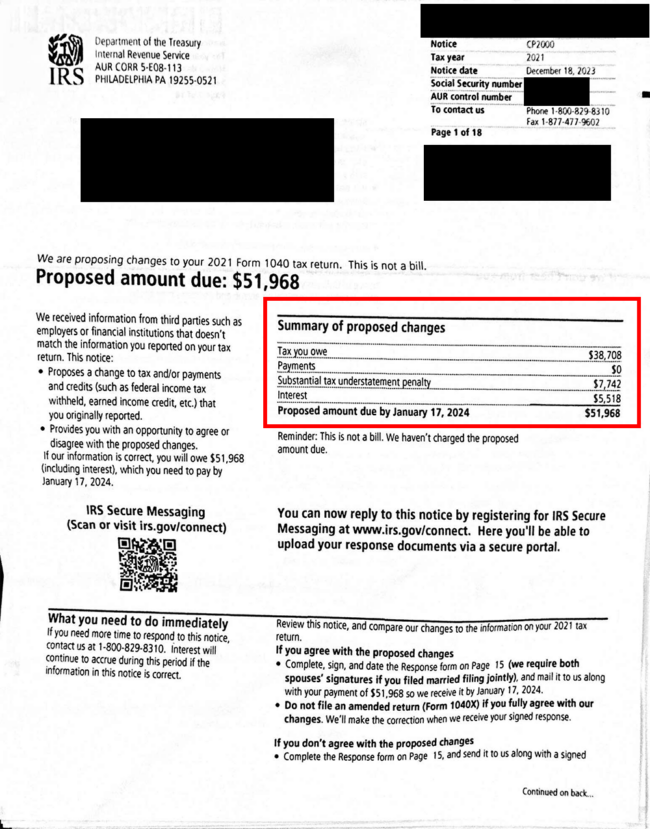

CP2000 notices state the amount the IRS believes the recipient owes, which includes accrued interest.

Example of a CP2000 letter for crypto trading:

If you receive a CP2000 crypto letter, think the amount is correct, and you want to pay the debt and be done with it, then fill out the form and remit it with a check. Voila. You’re done.

However, the IRS may not be correct. For cryptocurrency investors in particular, CP2000 letters can be notoriously inaccurate; keep reading or watch this video to learn why.

Why did I receive a CP2000 crypto letter?

If you received a CP2000 notice about cryptocurrency, it’s because the IRS has information about your trading activity, and this information doesn’t match what you’ve reported on your tax return.

The IRS has powerful data comparison tools, and it routinely checks the information on your tax returns against information from third party sources.

For example, if your employer sends you a W2 form at the beginning of the year, they must also send the same form to the IRS. The IRS will compare the income reported by your employer to the number you report on your tax return. The same is true of capital gains acquired through cryptocurrency trading.

Increasingly, crypto exchanges are sending information about their users’ trading activity to the IRS using Form 1099-K, Form 1099-MISC, or 1099-B. But the 1099-K for crypto traders is often wildly inaccurate because it reports only your total sales volume.

Form 1099-B is typically the most accurate, but it can still be lacking if you use more than one wallet or exchange. (For example, moving your crypto from one wallet to another could be recorded as a taxable transaction when it’s actually not.)

So, if the IRS has received Form 1099-K, Form 1099-MISC, or 1099-B reporting your crypto activity from a company like Coinbase, and you did not fully report crypto on your tax return, then you’re a prime target for a CP2000 notice claiming that you owe additional tax.

I don’t agree with the amount on my crypto CP2000. What should I do?

If you disagree with the amount the IRS claims you owe, be sure to hang onto the CP2000 cryptocurrency letter and contact our cryptocurrency tax lawyers right away. You have 30 days to prepare a response.

We’ll get to work responding to the IRS, and creating all supporting documentation, by the deadline stated on your notice.

We’ll build your complete crypto tax report for the year(s) in question (we can amend a previous report or start from scratch). This includes recording every single cryptocurrency transaction that you made. We’ve been working with crypto taxes for years and have built hundreds of these reports, so you’ll be in good hands.

Find Straightforward, Experienced Help with Your CP2000 Response

The worst thing you can do with a CP2000 notice is ignore it; the IRS can, and eventually will, take extreme collection measures like filing a lien on your property or even levying your bank account.

Don’t wait until it’s too late. Our experienced cryptocurrency tax attorneys can help you resolve this issue with minimal stress and expense. Reach out today to schedule your consultation with an attorney.