Are you stressed about the upcoming tax return filing deadline and need more time to file your returns? Fortunately, the IRS offers an extension, allowing you more time to prepare and file your tax return. The extension for the federal tax return gives taxpayers an additional 6 months to file.

Gordon Law can help make the tax return process less stressful. Our experienced team can guide you through the process by filing your extension and preparing your tax return so you don’t have to worry.

The standard deadline for filing your 2024 federal tax return with the IRS is April 15, 2025. If you apply for an extension for time to file, your due date will be extended to October 15, 2025. Applying for an extension is an opportunity to slow the process and ensure everything is in order before filing your return.

How to File an Extension

The extension for additional time to file your federal tax return is not automatically granted. You must file a form with the IRS on or before the original due date of your return, informing them you need more time to file. The due date for most individuals is April 15 of each year.

Most individuals will use Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to request their federal extension. You can electronically file Form 4868 for free through the IRS website’s Free File program. We’ve included step-by-step instructions below to help you file your file extension form.

Meanwhile, most businesses will use Form 7004, Application for Automation Extension to File Certain Business Income Tax, Information and Other Returns. You can file this online using the MeF Internet Filing system from the IRS.

If you use tax software like TurboTax or H&R Block to file your tax return, you can also file an extension with their software. Or, if you hire Gordon Law to prepare your tax return, we can file the extension for you!

Request an Individual Tax Extension on the IRS Website: Step-by-Step Guide

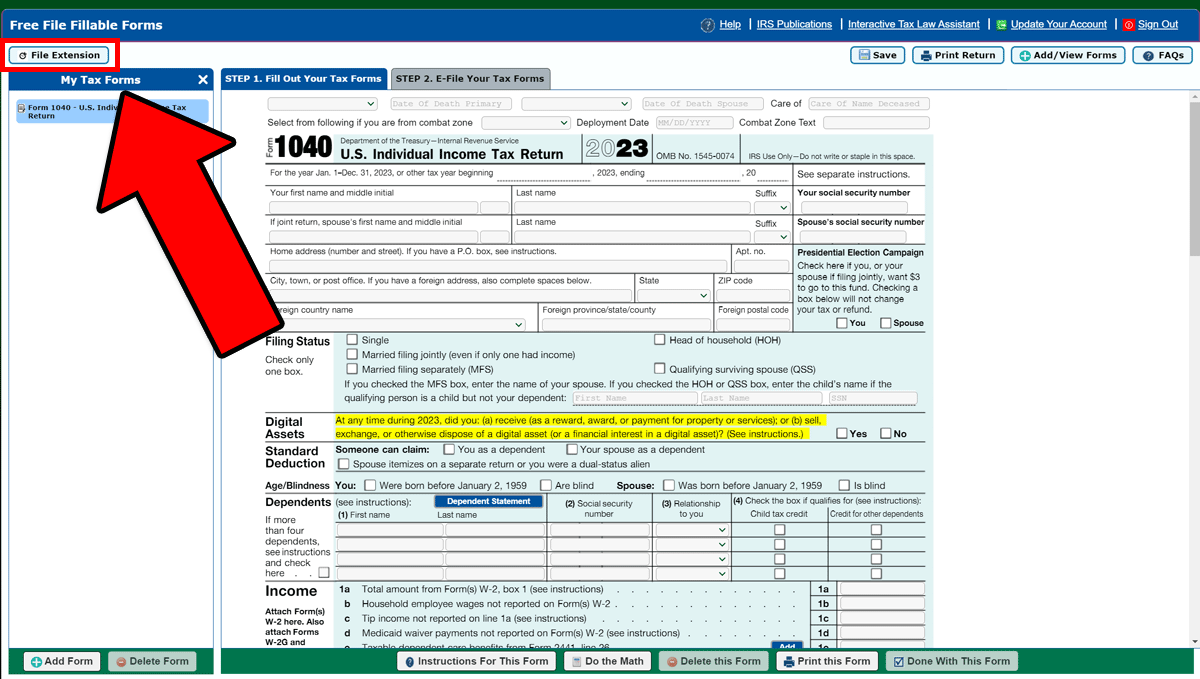

- Navigate to the IRS website’s Free File program.

- Choose the ‘Fillable Forms’ option. Then, create an account.

- Click ‘File Extension.’

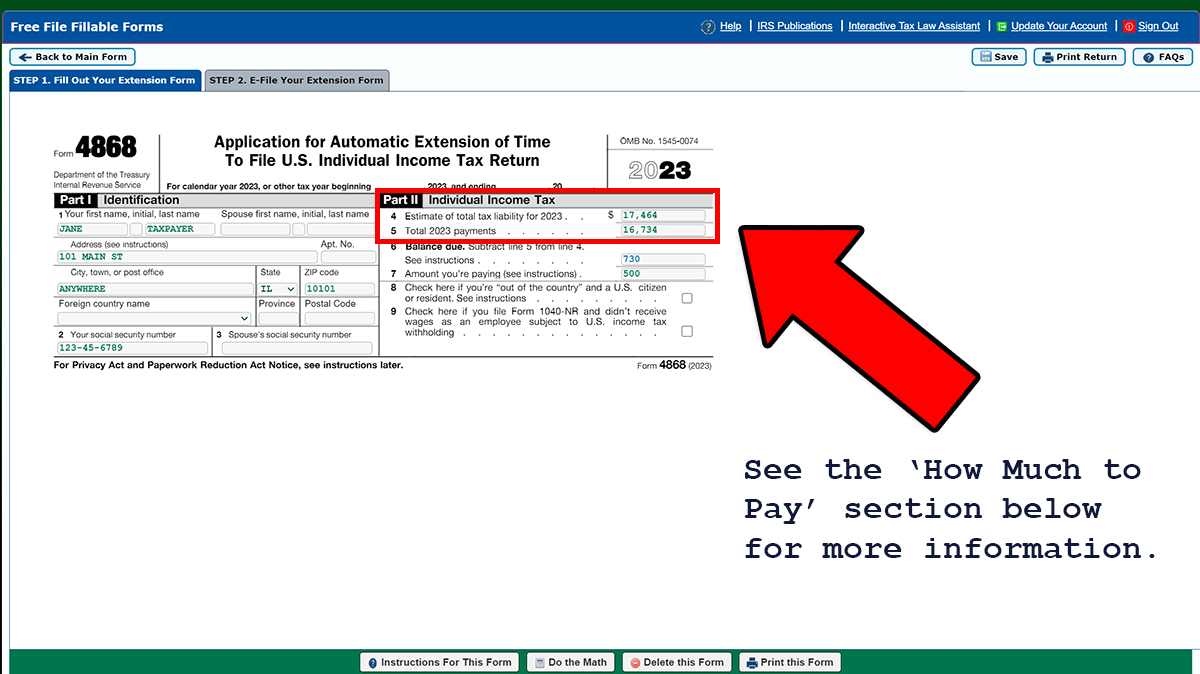

- Fill out the information on this screen. To find your estimated liability, see our How Much to Pay section below.

- For self-employed individuals, it’s more complicated. You often base the amount on last year.

- It’s not really a huge deal if you estimate wrong. If you pay less than you owe, you’ll be charged penalties. If you overpay, you’ll receive a refund.

- For the amount paid, use the federal withholding from your Form W-2. For self-employed individuals, use your estimated tax payments.

- Balance due will calculate automatically when you click ‘Do the math.’

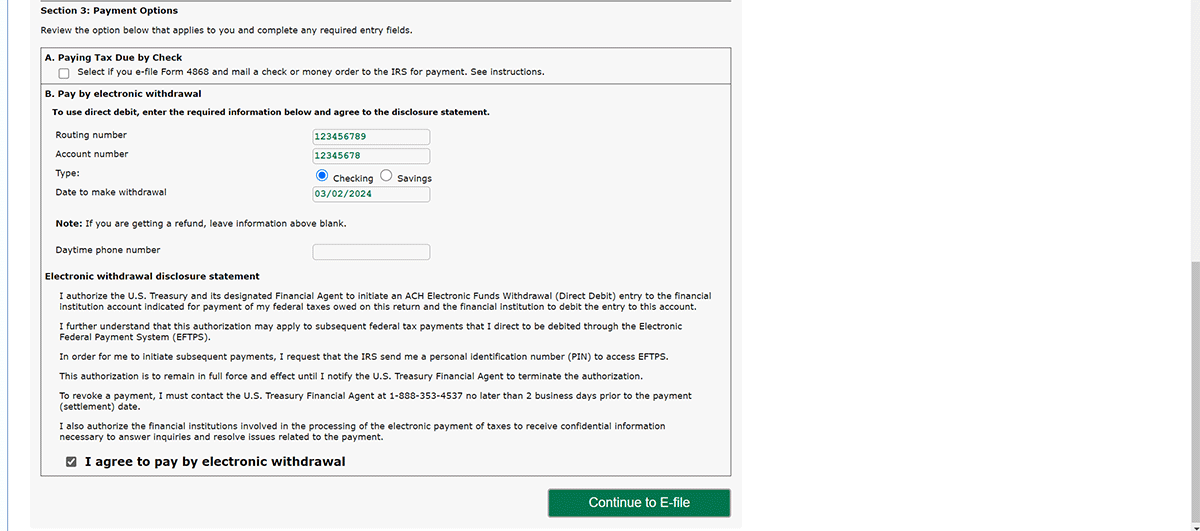

- You can make a payment or not—see further information below.

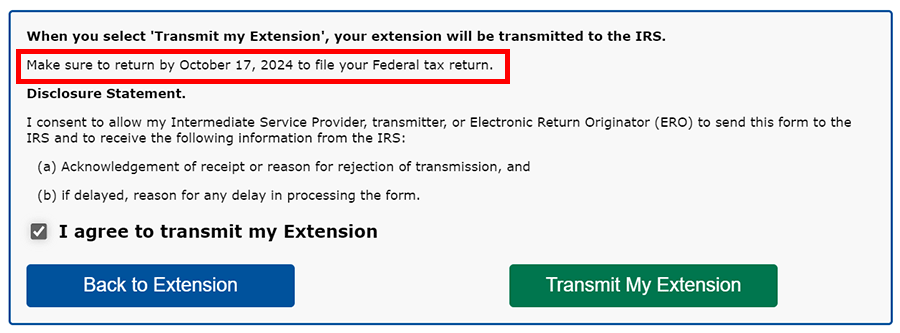

- Submit IRS Form 4868. Be sure to note your new filing deadline; it’s typically October 15, but it may be slightly different if October 15 falls on a weekend.

How Much to Pay

So you need to file an extension for more time to file, but you think you may owe and want to make a payment before the April 15 deadline. How can you calculate how much you owe without preparing your tax return first?

To estimate what you owe on your federal return, you can calculate your balance due using one of the following options:

- Complete Form 1040-ES: Use the 2023 Form 1040-ES, Estimated Tax for Individuals,and follow the instructions to calculate your estimated liability and balance due based on your 2023 income. Use line 11c on the form for your estimated liability, line 13 for payments, and line 14b for your balance due.

- Use Last Year’s Numbers: If you earned about the same income in 2023 as in 2022, you can use your 2022 tax as your 2023 estimate liability and your 2023 withholdings and other payments you made during the year on the payments line. The difference between these two amounts is your balance due.

- Estimate Tax Owed Using Online Tools: Alternatively, tools are available online that can help you estimate how much you may owe the IRS without going through the entire process of preparing your tax return.

- Estimate Tax Paid Using Your W-2 or Estimated Payments: To determine how much tax you’ve already paid, refer to your W-2 (if you’re an employee) or your estimated tax payments (if you’re self-employed).

Return to Extension Filing Instructions.

Remember: An Extension to File Is Not an Extension to Pay

The extension granted by the IRS for additional time to file only extends the filing due date of the tax return; it does not extend the due date to pay. If you owe on your federal tax return, this amount is due by the original due date of April 15, and no extensions are available for more time to pay. If you do need more time to pay, the IRS offers payment plan options that you can look into to see if they work for your situation.

State Tax Considerations

In addition to the federal tax return extension, you may also need to file an extension with the state taxing authorities. Consult your state’s website or tax software to determine whether you need to file for an extension with any state.

If you need assistance preparing your tax return or filing an extension, Gordan Law can help. We make your tax season simple and stress-free! Contact us today to discuss your situation.