Tax Debt Lawyer: Get the IRS Off Your Back!

Have you been slapped with an unfair tax bill? Are you unable to make payments on your IRS debt? You need an experienced tax debt lawyer on your side.

We’ve saved our clients millions on their taxes. Don’t wait—the sooner you contact Gordon Law, the sooner you can be free of your tax debt stress!

Contact us online or call (847) 580-1279 for a consultation.

Drowning in tax debt? You may find relief via an IRS Offer in Compromise, or OIC—an option that allows taxpayers to reduce outstanding IRS tax debts. We’ve guided countless clients through this program and negotiated their tax bills down to pennies on the dollar.

But be warned: The rules are inflexible and messing up can be costly. If you’re considering an Offer in Compromise, you need an experienced IRS debt lawyer who will fight for your rights, deliver the lowest tax bill possible, and be honest about what you can expect.

Are you facing tax debt due to your spouse’s (or former spouse’s) actions? If you had no knowledge of their tax issues, you may qualify for Innocent Spouse Relief. This will reverse IRS collections of back taxes, penalties, and interest.

We’ve successfully helped many clients file for Innocent Spouse Relief. If the IRS is breathing down your neck, call our experienced tax attorneys today at (847) 580-1279 for a confidential consultation.

In addition to tax debt, you may incur tax penalties—most commonly for non-filing and non-payment. However, in some cases, you may be eligible for tax penalty abatement.

Penalties can add up quickly, making it even more difficult to pay off your tax debt. Penalty abatement can help reduce or eliminate these penalties, making it easier to pay off your tax debt over time.

There’s nothing worse than the IRS taking your hard-earned money while you’re struggling to make ends meet. If you are unable to pay your tax debt due to financial hardship, you may be able to apply for Currently Non Collectible status, which temporarily suspends collection efforts. This can give you time to get back on your feet and avoid more serious consequences.

Want to explore this option? Speak to a tax relief attorney today! Contact Gordon Law online or call (847) 580-1279.

Did you know you can settle tax debt with an IRS installment agreement? This can help you pay off your tax debt within a predefined time limit, and finally rest easy knowing your tax woes have come to an end. There are 2 types of installments available:

Streamlined Installment Agreement

A Streamlined Installment Agreement may be the best option for paying IRS tax debt if your debt is below $50,000. Unlike other payment plans, if you qualify for a Streamlined Installment Agreement, you do not have to provide the IRS financial information such as your income, expenses, or equity in assets. However, the balance must be paid off within six years or before the Collection Statute Expiration Date. Interests and penalties may still be issued by the IRS until the full amount is paid.

Complex Installment Agreement

A Complex Installment Agreement is a payment plan for taxpayers who owe over $50,000. The balance must be paid off within 5 years (60 months) or before the Collection Statute Expiration Date. Interests and penalties may still be issued by the IRS until the full amount is paid.

With a Complex Installment Agreement, you must provide your financial information to determine a minimum monthly payment. The payment amount is calculated by subtracting monthly allowable expenses from your monthly gross income.

Our experienced tax debt attorneys can negotiate your monthly payment down to as little as possible, helping you finally find the relief you need from overwhelming tax debt.

Call (847) 580-1279 or contact us online today to schedule a confidential consultation.

Experienced, Skilled, and Personal Tax Relief

If you’re facing IRS or Illinois tax debt, don’t go it alone. Hiring an experienced IRS debt lawyer in Chicago can save you a substantial amount of money and make the process much easier. We’re here to fight for you and provide clear, honest guidance every step of the way.

Don’t wait another moment—contact the experienced tax debt lawyers at Gordon Law for a consultation now!

Associate Attorney - Tax Resolution

Meet your tax debt resolution team.

Highly experienced IRS attorneys

dedicated to your peace of mind.

Average experience: 14 years

Andrew Gordon, Esq., CPA

Partner

Daniel Urban, Esq.

Manager – Tax Resolution

Featured Resources

How to Stop IRS Wage Garnishment (2025)

If you’re facing IRS wage garnishment, you may feel confused, angry, and overwhelmed. But you have options! Learn how to stop the IRS garnishing your wages.

How to Stop Illinois Department of Revenue Collections (2025 Update)

Are you struggling with Illinois Department of Revenue collections? Do you have overwhelming Illinois tax debt that you can’t afford to pay? You have options, and our Chicago tax law firm can help!

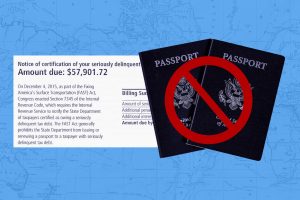

Why an IRS Notice CP508C Could Mean Losing Your Passport

Did you just receive an IRS Notice CP508C? If so, it’s a sign that your tax debt has reached a serious level. And financial consequences aside, you’re now at risk of losing something that you might take for granted–your passport.

Tax Debt Services in Chicago, IL

Proven tax debt attorneys

Need tax debt help? Our skilled tax attorneys will negotiate with the IRS or Illinois Department of Revenue on your behalf and secure your lowest possible settlement.

Once you have tax debt, the IRS penalties and interest add up faster than many people can pay. It may feel like you’re drowning with no way out. We’ve helped countless clients negotiate with the IRS, settle their tax bills, and get their finances back on track.

We can help you with tax debt resulting from an audit, back taxes, an IRS notice, or any number of other scenarios.

We pride ourselves on delivering unbeatable results and exceptional customer service throughout your case. We’re committed to providing personal and prompt attention to each and every client. With Gordon Law, you not only have experience on your side, but a dedicated, passionate team of attorneys you can always rely on!

What are you waiting for? Contact us online or call (847) 580-1279 NOW to free yourself from overwhelming tax debt!

Ask a tax debt lawyer

Yes, a tax attorney can negotiate with the IRS on your behalf to help resolve your tax debt issues. IRS debt lawyers have focused knowledge and experience in tax law and can negotiate with the IRS for a variety of tax relief options, including payment plans, offers in compromise (OIC), and penalty relief.

A tax attorney can also represent you in tax court and help you navigate the complex tax system.

We typically recommend hiring a tax relief attorney when your debt is $75,000 or more. For smaller amounts of tax debt, you may be able to navigate IRS payment plans on your own or use the help of a free tax clinic.

Call the tax attorneys at Gordon Law if you need help with your IRS debt!

While it is not required to hire an attorney to help with tax debt, it can save you substantial money if your tax debt is $75,000 or more. We frequently save clients thousands and even millions of dollars on taxes, penalties, and interest!

Tax attorneys have the knowledge and experience to help you navigate the complex tax system and negotiate with the IRS for tax relief options. Why spend your time on hold with the IRS or trying to understand complicated tax laws when you could have a trusted professional handle the matter for you?

An IRS debt attorney can also offer attorney-client privilege—a stronger form of confidentiality than a CPA or Enrolled Agent can provide.

There are several ways to get tax debt forgiven, including through an offer in compromise, innocent spouse relief, and, in some cases, bankruptcy.

An offer in compromise (OIC) is a settlement with the IRS that allows you to pay less than the full amount owed. Innocent spouse relief is available to taxpayers who are not responsible for their spouse’s tax debt. Bankruptcy may also be an option for some taxpayers to discharge or reduce tax debt, although it must be done in a specific way.

It is recommended to consult with a tax attorney to find a course of action for your individual situation. Contact Gordon Law today!

The amount that the IRS will settle for varies depending on your financial situation and the amount owed. Generally, the IRS will consider factors such as income, expenses, and assets when determining the amount of a settlement. The rules for a tax settlement are very strict, so it’s important to calculate your offer correctly to avoid delays.

Our experienced IRS tax settlement attorneys can negotiate with the IRS on your behalf and help you reach a settlement that is favorable to you.

To get an IRS lien removed, you must pay off your tax debt in full or enter into a payment plan with the IRS. Once the debt is paid off or the payment plan is established, the IRS will release the lien.

The tax debt lawyers at Gordon Law are highly experienced with IRS and Illinois tax liens and can help get you back on track ASAP! Give us a call at (847) 580-1279 to schedule a consultation.

The typical cost for professional tax debt help is anywhere from $10,000 to $20,000, depending on the specific circumstances.

For a personalized quote, schedule a consultation with a tax debt lawyer! You can contact Gordon Law online or call us at (847) 580-1279.