The FBAR, or Foreign Bank Account Report, is a form that must be filed annually by individuals who have foreign financial accounts with a total combined balance of $10,000 or more. Failure to file can result in significant FBAR penalties for individuals to understand their obligations and how to avoid penalties.

Whether you are a U.S. citizen with foreign accounts or a foreign national with U.S. accounts, this information is crucial to ensure that you comply with the law and avoid costly fines.

What Are FBAR Penalties?

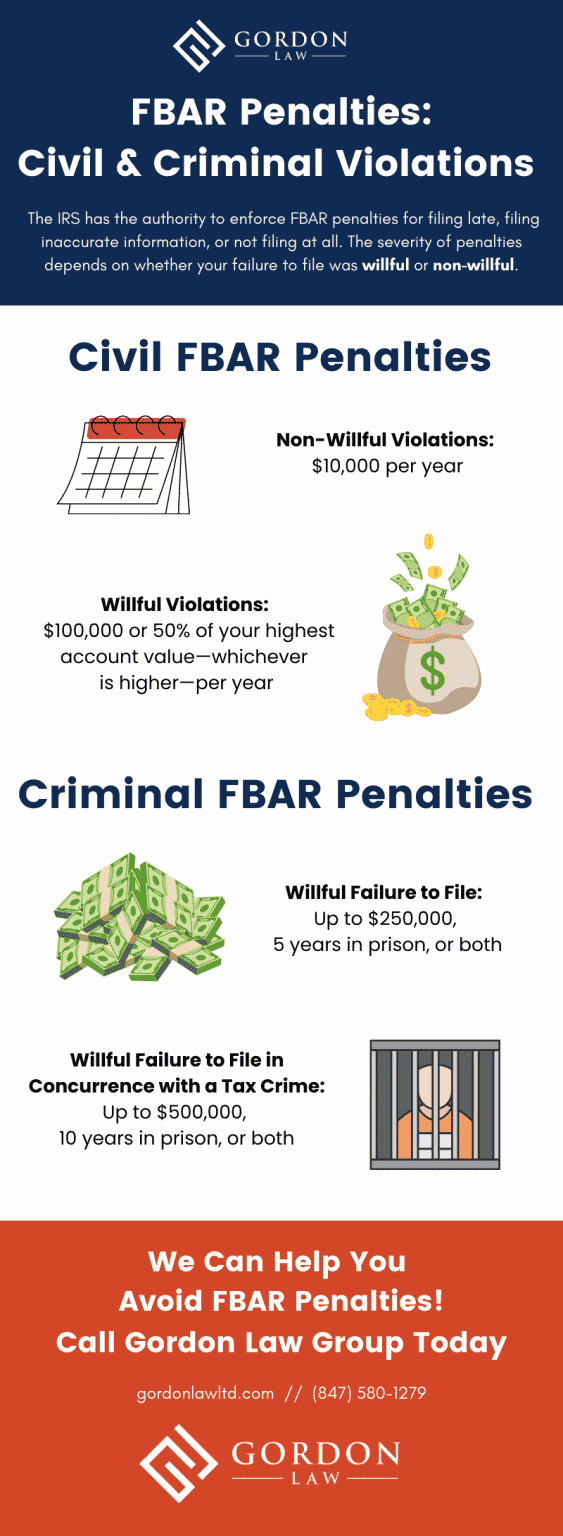

Although FinCEN regulates FBAR filing, the IRS can enforce FBAR penalties for filing late or not filing at all. The severity of penalties depends on whether your failure to file was willful or non-willful.

You can receive an FBAR penalty for any of the following reasons:

- Not filing an FBAR when it was required

- Filing an FBAR but omitting one or more required accounts

- Filing an FBAR with inaccurate account values

FBAR penalties can be civil or criminal. Penalties are harsher if the IRS deems your actions willful (intentional).

Civil FBAR Penalty

For non-willful violations, the civil FBAR penalty is usually $10,000 for each year you didn’t file, but it ultimately depends on the number of violations (accounts not reported or misreported) and the value of those accounts.

For willful violations, you can be fined $100,000 or 50% of your highest account value—whichever is higher. The IRS can assert these penalties for each year you didn’t file.

For example, if you willfully didn’t file FBARs for 5 years, you could be fined $500,000 or more!

Criminal FBAR Penalty (Willful Violations)

In some cases, the IRS can pursue criminal prosecution and civil penalties. Criminal penalties include:

- Willful failure to file: A fine up to $250,000, 5 years in prison, or both

- Willful failure to file in concurrence with another crime (such as tax evasion): A fine up to $500,000, 10 years in prison, or both

Willful failure to file an FBAR is a felony, so if you are convicted, you will lose the right to vote, lose professional licenses, and other associated penalties.

If you are not a United States citizen and are convicted of a felony, you will be deported after serving jail time.

What If I Haven’t Filed FBARs for Multiple Years?

If you didn’t know about your FBAR filing requirements or can otherwise show you acted non-willfully, you may qualify for a streamlined offshore disclosure and avoid harsh penalties.

If you filed the FBAR on time, but made a mistake or forgot to include important information, you can request an FBAR amendment. The IRS will decide if you acted willfully or non-willfully to determine which program you qualify for.

If you forgot about a foreign bank account that may have been dormant for years, the IRS generally considers this a non-willful act.

Taxpayers who acted non-willfully are eligible for the following submission procedures:

- Delinquent FBAR Submission

- Streamlined Domestic Offshore Procedures

- Streamlined Foreign Offshore Procedures

If you didn’t file and your actions were willful, you should call a tax attorney immediately to discuss your options.

You may be able to use the Voluntary Disclosure Program. While there are no guarantees, this program typically allows you to avoid criminal charges in exchange for paying IRS penalties.

Need Help With FBAR Penalties?

The FBAR process can be confusing, and one mistake can result in significant penalties. If you’ve found yourself facing some of these consequences, we’ve got you covered! Our FBAR lawyers can walk you through the options you have to get back into good standing with the IRS!

Give us a call today to schedule your free confidential consultation!