Understanding Form 8858, “Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches,” is crucial for navigating the complex world of international taxes, particularly for owners of offshore businesses or assets. This form provides transparency concerning certain types of offshore entities.

Many taxpayers are unaware of their obligation to file Form 8858, risking severe financial penalties for non-compliance. International taxes can be very confusing, both for taxpayers and professionals who don’t have specific experience in this realm.

At Gordon Law, we make tax filing simple and stress-free for everyone, including those with international tax concerns. In this guide, we’ll demystify the filing requirements for Form 8858, with detailed examples of who needs to file.

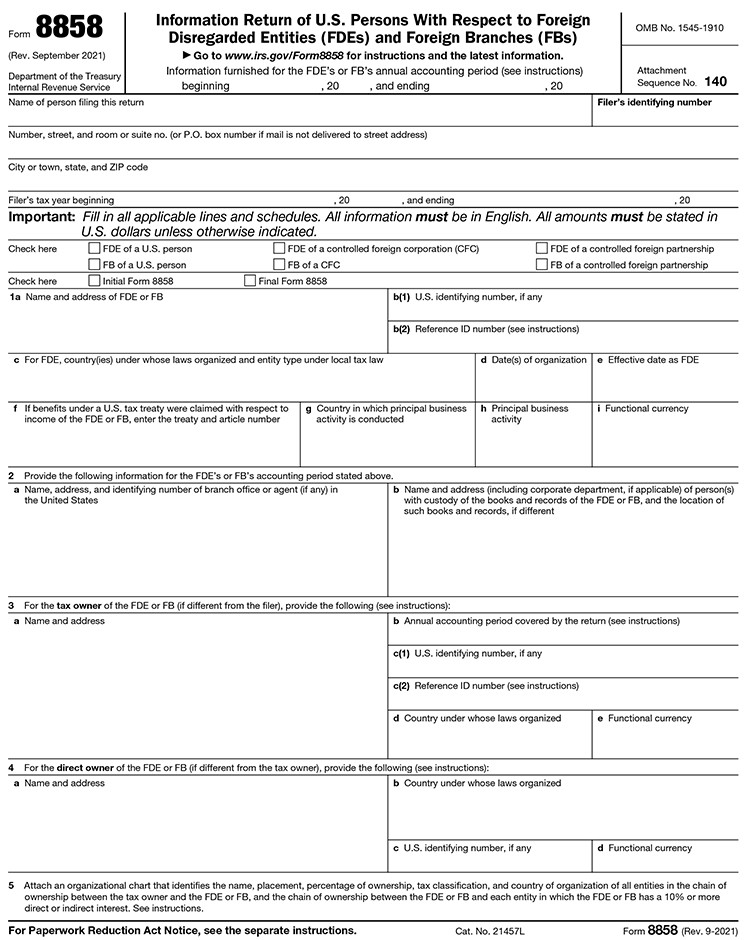

What is Form 8858?

Form 8858, “Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches,” is a tax form used by the IRS to collect information about certain foreign companies, or entities, owned by U.S. taxpayers. It reports information about the company’s ownership and financial details.

Since Form 8858 is an information return, it typically does not result in additional tax owed—unless you fail to file, in which case you can incur significant penalties. This form is intended to prevent U.S. taxpayers from hiding assets overseas and provide transparency around the ownership of foreign entities.

Form 8858 Filing Requirements

The filing requirements for Form 8858 are detailed and specific. Any U.S. person who owns or controls a Foreign Disregarded Entity (FDE), or who operates a Foreign Branch, must file this information return along with their annual tax return. For individuals, the filing deadline is usually April 15.

Filers must disclose various financial and operational details about their FDE or Foreign Branch. This includes income, expenses, assets, liabilities, and transactions between the FDE or Foreign Branch and its owner or other related entities.

If you’re not sure whether you need to file or have any questions about Form 8858, don’t hesitate to reach out to our experienced international tax attorneys.

What is a Foreign Disregarded Entity (FDE)?

A Foreign Disregarded Entity (FDE) is a business entity in a foreign country that is disregarded for tax purposes. This means the entity itself doesn’t pay any tax, but the income and tax obligations pass through to the owner(s).

Often, an FDE is a single-member LLC. It can be owned by an individual, corporation, trust, or other entity.

Who Must File Form 8858?

Form 8858 must be filed by U.S. persons, including individuals, corporations, partnerships, or trusts, that own a Foreign Disregarded Entity or operate a Foreign Branch. This applies to both tax owners and direct owners of the FDE. Consider these examples:

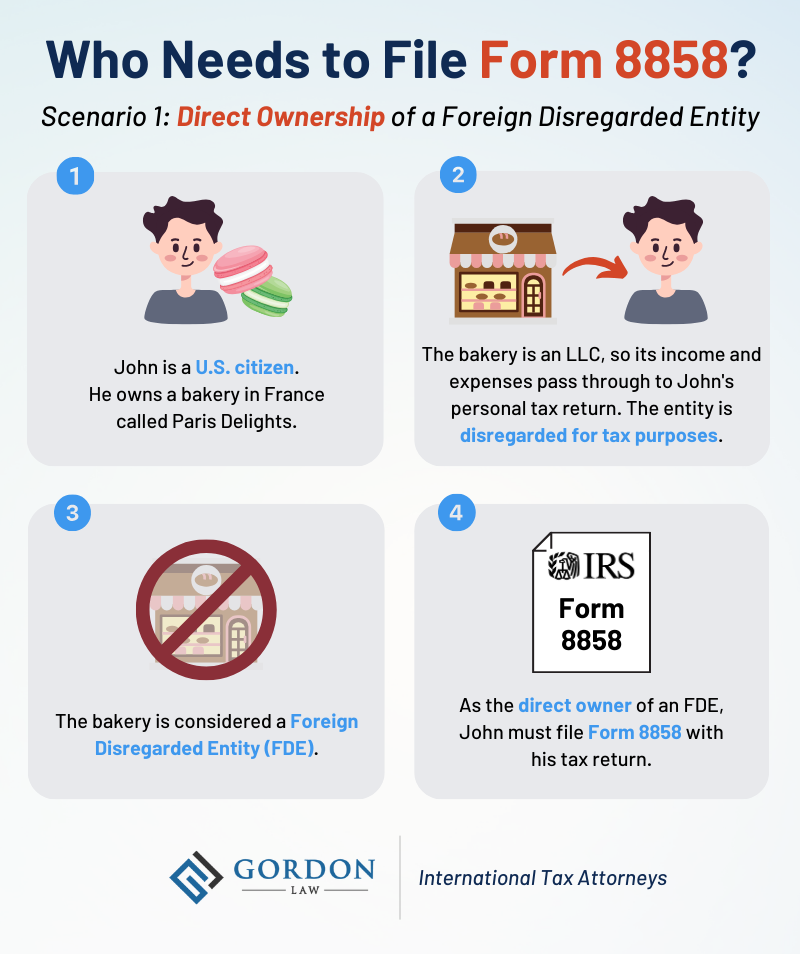

Scenario 1: Direct Ownership of a Foreign Disregarded Entity

John, a U.S. citizen, is the sole owner of a bakery in France named Paris Delights. This bakery is set up as a single-member LLC, meaning it’s owned entirely by John and is not considered a separate entity for U.S. tax purposes.

In this scenario, Paris Delights is a Foreign Disregarded Entity (FDE), and John is the direct owner. John has a responsibility to file Form 8858 along with his annual tax return.

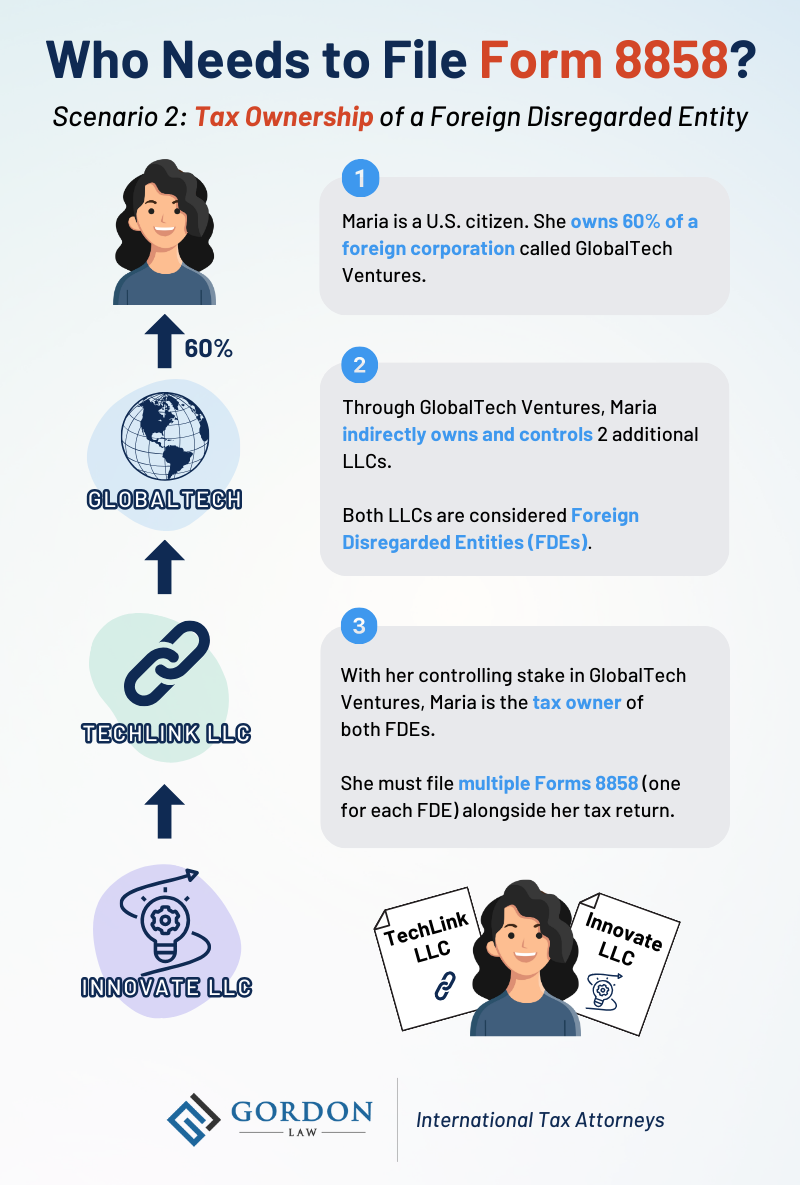

Scenario 2: Tax Ownership of a Foreign Disregarded Entity

Sometimes, the concept of ownership can be a little more complicated—typically, when one entity owns another. This is where tax ownership comes into play.

Maria, a U.S. citizen, owns 60% of a Controlled Foreign Corporation (CFC) named GlobalTech Ventures. GlobalTech Ventures owns a foreign subsidiary called TechLink Solutions, which is considered a Foreign Disregarded Entity. Complicating matters even further, TechLink Solutions owns another entity, Innovate International, which is also structured as a Foreign Disregarded Entity.

In U.S. tax terms, GlobalTech Ventures is the tax owner of both companies.

In this scenario, Maria has indirect ownership and control of two Foreign Disregarded Entities through her 60% stake in GlobalTech Ventures. Therefore, she’s obligated to file Form 8858 for both TechLink Solutions and Innovate International. She would also need to file Form 5471 to report information about the Controlled Foreign Corporation, GlobalTech Ventures.

The IRS mandates this to maintain transparency and oversight over U.S. persons’ involvement in multiple levels of foreign entities.

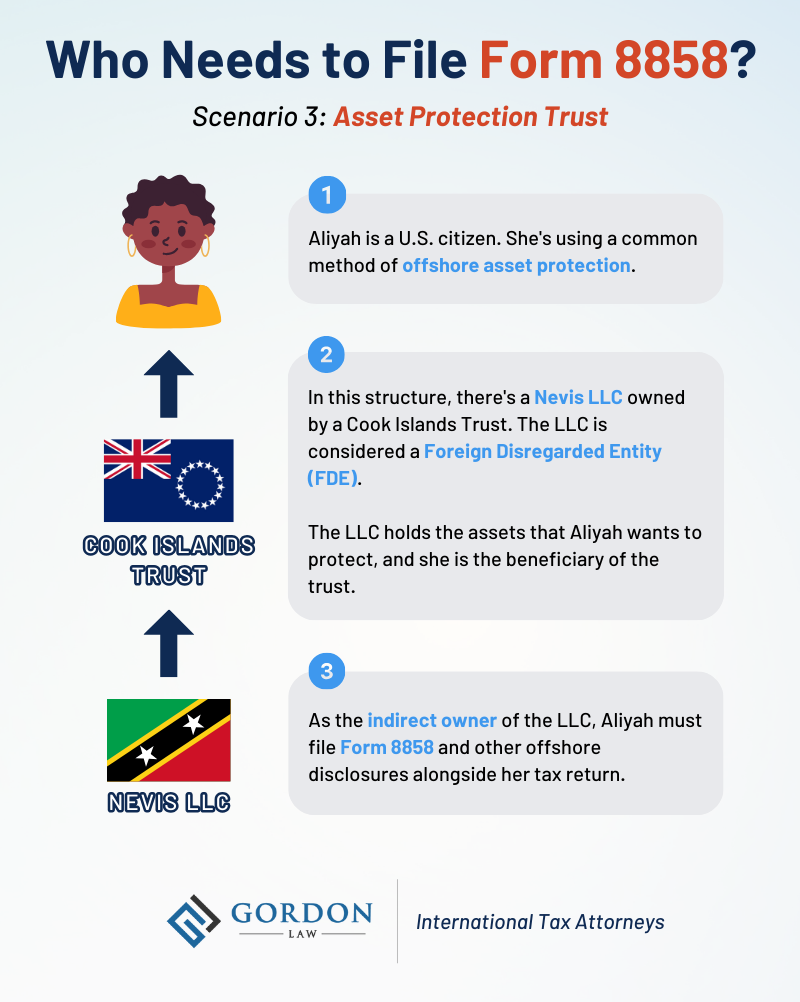

Scenario 3: Asset Protection Trust

Aliyah, a U.S. citizen, has established an asset protection structure using multiple offshore entities. It involves a Cook Islands Trust, called Global Safe Haven Trust, which owns a Nevis LLC, named Secure Assets LLC.

In this structure, Secure Assets LLC is a Foreign Disregarded Entity. Global Safe Haven Trust owns the LLC, and Aliyah is the primary beneficiary of the trust.

Aliyah is required to file Form 8858 with her U.S. tax return due to her indirect ownership of Secure Assets LLC. Additionally, Aliyah needs to file Forms 3520 and 3520-A related to foreign trusts.

Penalties for Non-Compliance with Form 8858 Filing

Understanding the potential penalties for failing to comply with Form 8858 filing requirements is crucial for U.S. persons with foreign disregarded entities or branches.

Failure to File

If you fail to file Form 8858 or provide insufficient or inaccurate information, the IRS can impose a penalty of $10,000 per tax year. You may be required to file multiple Forms 8858 each year, and this penalty applies to each instance of non-filing.

Continued Failure After IRS Notification

If the IRS sends you a notice that you must file Form 8858, you will receive 90 days to comply. After this 90-day grace period, an additional non-filing penalty of $10,000 may be charged every 30 days. The additional penalty is limited to a maximum of $50,000 for each failure.

Reduction of Foreign Tax Credits

Apart from monetary penalties, non-compliance with Form 8858 filing requirements can lead to a 10% reduction of Foreign Tax Credit benefits. This can have a significant impact on your overall tax liability.

Criminal Penalties

In cases of willful failure to file or fraudulent filing, criminal penalties including fines and imprisonment may be imposed. This underscores the seriousness with which the IRS views the obligation to report foreign entities and branches.

Reasonable Cause

It’s important to note that if you can show that the failure to file was due to reasonable cause and not due to willful neglect, the IRS may abate or not impose penalties. However, this is determined on a case-by-case basis and requires substantial documentation and justification.

How to File Form 8858

- Gather Information: Collect all relevant financial statements and transactional details of your FDE or Foreign Branch.

- Complete the Form: Fill in each part of Form 8858 carefully. Pay special attention to Schedule M, which requires reporting of transactions between the filer and the FDE or Foreign Branch.

- Attach to Tax Return: Form 8858 should be attached to your annual tax return (e.g., Form 1040 for individuals, Form 1120 for corporations).

- Review and Submit: Before submitting, ensure all information is accurate and complete. Mistakes or omissions can lead to penalties.

Need Help with Form 8858 and Other Offshore Disclosures? Gordon Law Makes It Simple

Navigating the maze of offshore disclosure requirements, including Form 8858, can be a daunting task. That’s where Gordon Law steps in. With a deep understanding of these intricate tax laws, our team is dedicated to making your tax filing as straightforward and stress-free as possible.

Whether you’re dealing with a Foreign Disregarded Entity, managing international business interests, or trying to untangle the web of global tax obligations, our experienced professionals are here to guide you through every step. We ensure that your filings are accurate, compliant, and timely, safeguarding you against potential penalties and legal complications.

If you have any questions about international tax filing, don’t hesitate to contact us for a free consultation.