NFT Creators and the Law: 5 Common Questions

Taxes for Venmo, PayPal, Zelle and more

Taxes for Sellers on Facebook Marketplace, eBay, and Etsy

What is the Trust Fund Recovery Penalty?

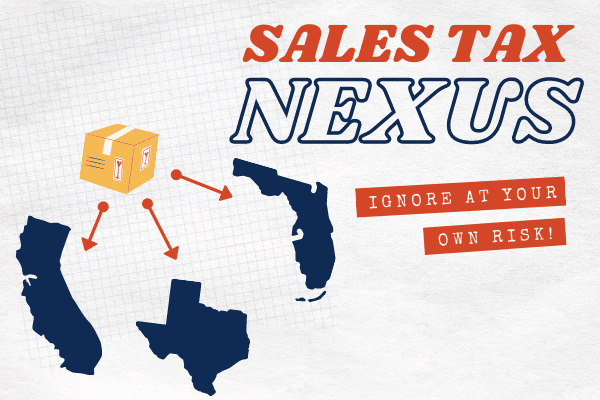

What is Sales Tax Nexus?

Failing to keep track of your sales tax nexus can lead to massive tax bills from multiple states.

Remote Working Tax Implications for Employers

California Is Hunting for Income Tax from Out-of-State Sellers