For U.S. citizens with ownership in foreign corporations, understanding Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations,” is essential. This form plays a pivotal role in international tax compliance, and this guide will help you grasp your filing responsibilities.

International tax filing can be very complex—even many CPAs are unfamiliar with Form 5471 and other, related forms. However, Gordon Law has extensive experience with international tax filing, and we’re here to guide you through a stress-free tax season.

Let’s break down the basics of this offshore tax form, including filing requirements, schedules, and filing instructions.

What Is Form 5471?

Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations,” is an IRS requirement for taxpayers with various levels of involvement in foreign corporations. It’s a tool for the U.S. government to ensure transparency and compliance in international finance.

Form 5471 is an information return rather than a tax return, which means it typically doesn’t affect how much tax you have to pay. Rather, it gives the IRS information about which U.S. persons have stakes in a foreign corporation. This helps prevent taxpayers from hiding funds overseas.

Some filers only need to report a small amount of information on this form, while others must report detailed information about the corporation’s finances. There are many nuances, exceptions, and exclusions, so be sure to reach out to an international tax professional if you have any questions.

Form 5471 Filing Requirements: Who Needs to File?

Any U.S. citizen, resident, trust, partnership, corporation, or estate that owns at least 10% of a foreign corporation must file Form 5471. (For the sake of simplicity, we’ll refer to all of the above as a “U.S. person” throughout this article.)

This form is filed alongside your annual tax return. For individuals, the filing deadline is April 15 each year.

As you’ll see below, this form has several different categories of filers, each with their own requirements.

5471 Category Filers

There are several categories of filers for this offshore tax form. Your category determines which schedules you have to file. While there are many nuances, subcategories, and exceptions, here’s a simple list of the Form 5471 category filers:

Category 1 – Specified Foreign Corporation

This category applies to ownership of a Specified Foreign Corporation (SFC). It can be triggered in 2 ways.

- If a U.S. shareholder owns a Controlled Foreign Corporation, and that U.S. shareholder owns at least 10% or more of the total combined voting power or value of shares during the applicable tax year, they are a Category 1 filer.

- Similarly, if a foreign corporation is owned by at least one or more U.S. corporations, then the foreign corporation is a Specified Foreign Corporation. A U.S. person who owns the SFC is a Category 1 filer.

Category 2 – Officers or Directors

This applies to any U.S. person who was an officer or director of a foreign corporation which meets either of these criteria during the tax year:

- A U.S. person has acquired at least 10% of stock ownership; or

- A U.S. person has acquired an additional 10% of the outstanding stock.

Note that the filing requirement is triggered when any U.S. person acquires this stock—not necessarily the officer or director who has to file.

Category 3 – Stock Acquisition or Disposition

This applies to any U.S. person who acquires at least 10% of the stock of a foreign corporation. A smaller acquisition could trigger the filing requirement if it brought the person’s total ownership to 10% or more.

This also applies to a U.S. person who disposes of enough stock in a foreign corporation to reduce his or her interest to less than 10% stock ownership requirement.

Category 4 – Control for At Least 30 Consecutive Days

This applies to any U.S. person who had control of a Controlled Foreign Corporation (CFC) for at least 30 consecutive days during the corporation’s annual accounting period.

Category 5 – Ownership in a Controlled Foreign Corporation

This applies to any U.S. person who owns at least 10% of a Controlled Foreign Corporation (CFC).

What Is a Controlled Foreign Corporation (CFC)?

A Controlled Foreign Corporation, or CFC, is a foreign company where the majority of the company is owned or controlled by U.S. shareholders, each of whom owns at least 10% of the company. This is distinct from a foreign corporation (lowercase), which is simply any corporation based overseas.

The CFC designation affects Categories 1 and 5 above.

Instructions for Filing Form 5471

To file Form 5471, first determine which filing category applies to you and which schedules you’re required to complete (see below). These requirements can be confusing, including for tax professionals who are unfamiliar with international tax forms. If you have questions, don’t hesitate to reach out.

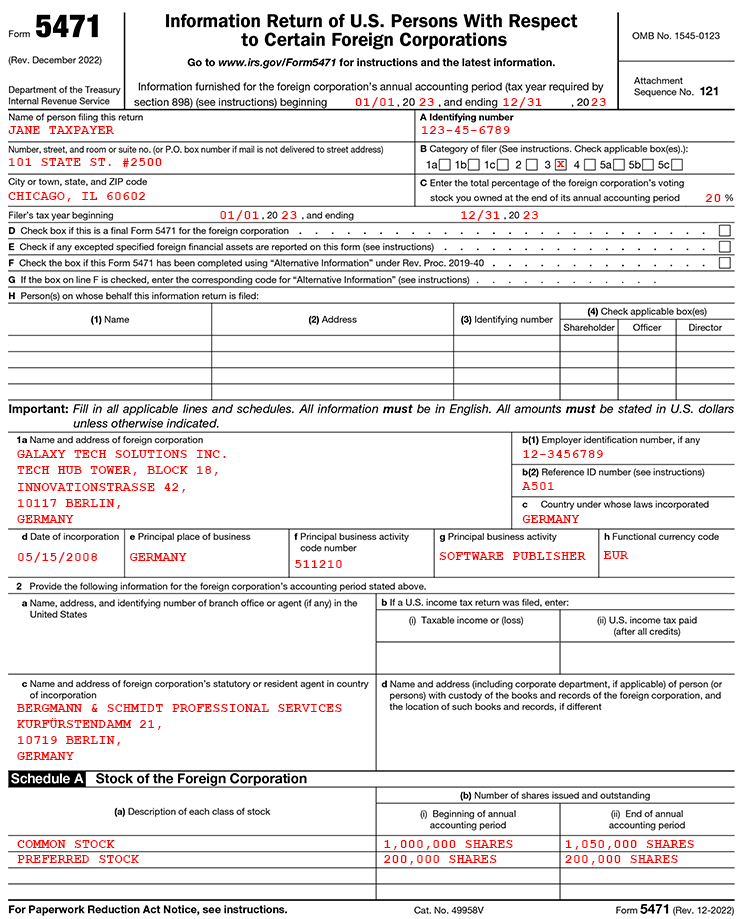

Next, complete the main section of the form, which contains information about the filer(s) and the foreign corporation in question. Page 1 of completed form might look like this:

Then, complete the required schedules for your filing category. Some schedules simply require basic information (such as how much stock you acquired), while others require detailed information about the corporation’s finances.

Finally, submit the form along with your income tax return.

Form 5471 Schedules

The main portion of Form 5471 reports information about the filer and the foreign corporation. In addition, there are 12 schedules that you may need to fill out, depending on your filing category. The schedules are:

- Form 5471 Schedule A – Stock of the Foreign Corporation

- Form 5471 Schedule B – U.S. Shareholders of Foreign Corporations

- Form 5471 Schedule C – Income Statement

- Form 5471 Schedule E – Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Form 5471 Schedule F – Balance Sheet

- Form 5471 Schedule G – Other information

- Form 5471 Schedule H – Current earnings and profits

- Form 5471 Schedule I – Summary of Shareholder’s Income from Foreign Corporation

- Form 5471 Schedule J – Accumulated earnings and profits of Controlled Foreign Corporations

- Form 5471 Schedule M – Transactions between controlled foreign corporation and shareholders or other related persons

- Form 5471 Schedule O – Organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock (Part I to be completed by U.S. officers and directors, Part II to be completed by U.S. shareholders)

See a table of which schedules must be filed for which categories here.

Subpart F Income and GILTI

Subpart F Income and Global Intangible Low-Taxed Income (GILTI) rules play an important role in the context of this form. Understanding these provisions is vital for U.S. shareholders of CFCs.

- Subpart F Income pertains to certain types of income earned by a CFC that must be reported by the U.S. shareholder.

- GILTI, introduced in the Tax Cuts and Jobs Act of 2017, involves complex calculations to report income from foreign corporations.

Form 5471 Penalties: What Happens If You Don’t File?

Failing to file Form 5471 can lead to significant penalties, starting at $10,000 per form for each tax year the form is not filed. The IRS enforces strict penalties to ensure compliance, and these can accrue over time, making it crucial to file accurately and timely.

Need Help Filing Form 5471 and its Schedules? Gordon Law Makes it Easy

Compliance with international tax regulations can be daunting due to its complexity. Gordon Law Group is here to assist you in navigating these challenges. Our team can help ensure that your filings are accurate and compliant, providing peace of mind in your international tax matters.