In another bid to ensure tax compliance among high-income individuals, the IRS has launched a fresh initiative using funds from the Inflation Reduction Act. The agency is actively pursuing cases of high-income non-filers, particularly those with incomes exceeding $400,000. This announcement comes close on the heels of an IRS audit campaign targeting high earners.

If you find yourself in the IRS’s crosshairs, there’s no need to panic, but it’s crucial to be well-prepared. Here’s a comprehensive guide to help you navigate potential tax liabilities, penalties, and the risk of criminal investigations.

Who’s Under the IRS Spotlight?

The focus of the new IRS initiative is on high-income taxpayers who failed to file federal income tax returns for the years 2017 to 2021. Specifically, the IRS is honing in on individuals with income surpassing $400,000, as indicated by third-party information such as Forms W-2 and 1099s.

Taxpayers in this campaign will receive notifications from the IRS, urging them to promptly file their taxes. These taxpayers are not yet being audited, but are at a heightened risk of facing IRS audits for failing to timely file returns.

Why Target Wealthy Non-Filers?

The sporadic implementation of the IRS non-filer program since 2016 was primarily due to budget and staff limitations. With the infusion of new funding from the Inflation Reduction Act, the IRS is strategically allocating resources to focus on cases with high potential for collections that require comparatively low effort. Andrew Gordon, Managing Partner, describes this effort as “very low-hanging fruit for the IRS.”

How to Prepare for the IRS Non-Filer Campaign

If your income exceeds $400,000 and you have neglected to file a federal tax return for at least one year between 2017 and 2021, it’s crucial to brace yourself for the IRS’s non-filer campaign. But fret not; there are proactive steps you can take to safeguard your interests.

1. Respond Promptly to IRS Notices

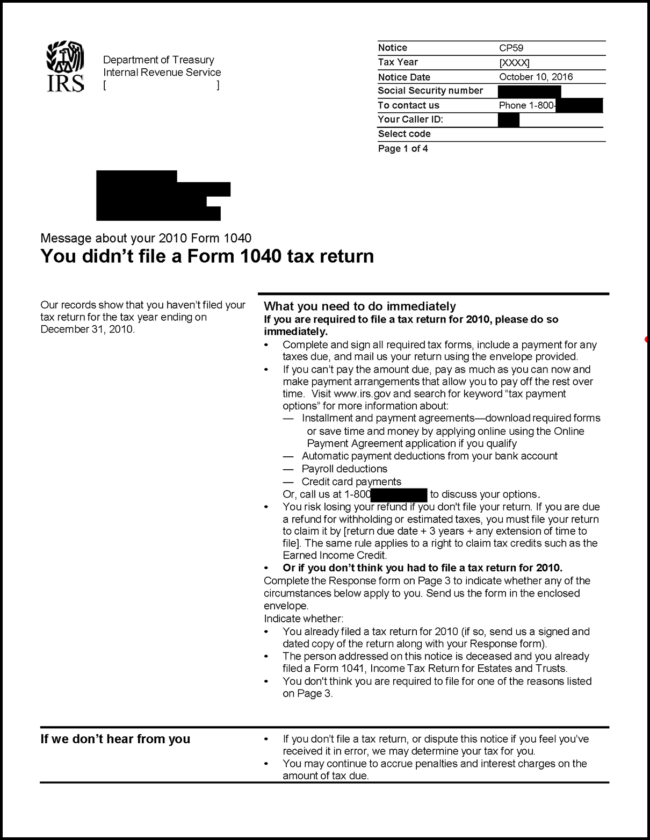

The IRS has initiated the mailing of CP59 Notices, formal alerts for failure to file a tax return, to over 125,000 taxpayers. Responding promptly within the 90-day deadline can prevent an audit and unwanted tax bills. Ignoring the notice, however, all but guarantees an audit or other unfavorable results.

Example of IRS Notice CP59 for unfiled tax returns.

Taxpayers who don’t respond to the non-filer letter will receive additional notices and other actions. Here’s what’s likely to happen:

- After sending multiple notices to delinquent taxpayers, the IRS may file a Substitute for Tax Return. The IRS will use the information it has available to prepare the tax returns in question and assess your tax liability. This is bad news for taxpayers because a substitute tax return probably won’t account for credits, deductions, or capital losses that could save you money.

- The IRS may propose an amount due, including your tax liability, interest, and penalties. Typically, you’ll get 90 days to respond and, optionally, dispute the amount. This initiates an audit of the tax returns in question; you need to provide adequate proof of how much you really owe.

- Once the tax due amount is formally assessed, collections begin and it becomes very difficult to dispute the debt.

Pro Tip: It’s always best to avoid an IRS audit if possible. Once Pandora’s Box is opened, the IRS may look at additional years or uncover additional items of concern. The risk of a criminal investigation can greatly increase once an audit begins.

If you receive a CP59 non-filer notice, you should consult with a trusted tax professional so you can quickly file your late tax returns and pay delinquent tax, interest, and penalties. The failure-to-file penalty amounts to 5% of the amount owed every month–up to 25% of the tax bill.

Your tax preparer or an experienced tax attorney can help you respond to the notice and, hopefully, prevent an IRS audit.

2. Gather Your Records and Receipts

Taxpayers receiving notices should ensure the accuracy and completeness of their tax returns, as the IRS closely scrutinizes non-filers. Not filing tax returns is a risk factor that could trigger an audit–and this may expose taxpayers to examination on additional tax years at issue.

Maintaining records for at least 6 years is crucial, as the IRS may look back within this period. Failure to do so can jeopardize your defense in a potential audit and result in additional penalties.

3. Avoid Criminal Charges

For those with potential criminal tax concerns, consider whether the Voluntary Disclosure Program is a good option for you. We highly recommend consulting with a professional if you’re interested in this program, especially when a pattern of non-filing raises concerns about concealing income.

“The IRS may open a criminal investigation if there’s a pattern of activity and an effort to conceal income,” says Gordon. “Some of the taxpayers receiving these notices haven’t filed for several years. That may carry criminal concerns simply by its nature.”

4. Choose a Competent Tax Professional

Complex tax returns, particularly for individuals with multiple income sources, require the knowledge of seasoned professionals. Business ownership, offshore accounts, foreign company ownership, trust-related gifts, and cryptocurrency investments can add layers of complexity to your tax return.

To minimize the risk of errors and penalties, it is essential to engage a tax professional experienced in handling intricate tax returns, both when filing your back taxes and when filing annually.

The team at Gordon Law is highly experienced with complex tax returns and fully dedicated to your peace of mind. We’ll make the process as smooth as possible, ensure you don’t miss a single detail, and provide crystal-clear guidance throughout the process. Reach out today if you need help with unfiled returns.