The coronavirus pandemic has forced many of us to work from home, and it looks like the practice is here to stay. Even in a post-pandemic world, surveys suggest that employers are more willing than ever to hire fully remote staff.

For many, it’s a win-win: Employees can enjoy the comfort and convenience of working in their PJs, while employers have access to a nationwide talent pool. But if you’re an employer looking to board the work-from-home train by hiring an out-of-state employee, make sure you understand the tax implications of remote work.

Note: Many states have released COVID-specific guidelines regarding taxes for remote employees. If you had employees working from home in 2020 due to the pandemic, and are wondering what that means for your tax obligations, call our experienced tax attorneys!

Remote Working Tax Implications: In a Nutshell

- As an employer, you’re responsible for withholding federal, state, and local taxes from employees’ paychecks.

- In most cases, state level income taxes must be paid to the state where the employee conducts their work.

- If your company is based in a state with “convenience of the employer” rules—Arkansas, Connecticut, Delaware, Nebraska, New York, or Pennsylvania—then you must withhold income and payroll taxes for the state where your company is located, regardless of where your employees live and work.

- Employees in this situation may need to file 2 state tax returns to avoid being double-taxed.

- Finally, if you have a remote employee working in another state, your company may become subject to sales and use and/or income tax nexus within that state.

Is Your Remote Worker an Employee or Independent Contractor?

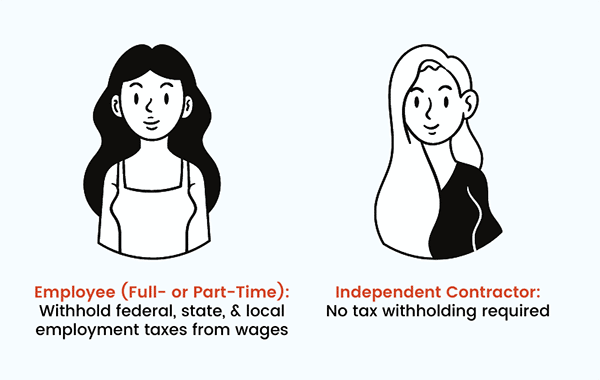

The classification of your remote worker—whether they’re an employee or independent contractor—makes a big difference in your tax obligations.

If you have an employee, you need to withhold federal, state, and local employment taxes from the employee’s wages. If you hire an independent contractor, you have no withholding obligations.

Obviously, hiring an independent contractor is much simpler since you don’t need to worry about taxes for that worker at all. Go ahead and hire to your heart’s content!

Just make sure that the worker is actually an independent contractor based on all applicable federal and state laws. California, for example, recently enacted AB5 (the “gig worker law”), which imposes stricter-than-average definitions of who can be considered an independent contractor.

Misclassifying an employee as an independent contractor to save on taxes can lead to big trouble for your business.

If you’re hiring a remote employee (full- or part-time), read on to see what that means for your taxes and withholding requirements.

Remote Working Tax Implications: What Do You Need to Withhold?

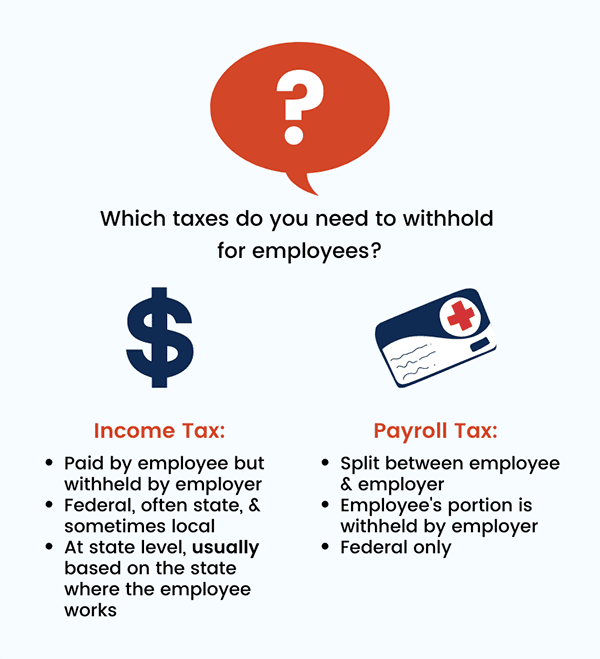

Before we dive in, it’s important to know which taxes are actually affected by the state your employee lives or works in.

Income tax is paid by the employee at the federal level, often at the state level, and occasionally at the local level based on their wages.

You must withhold certain portions of an employee’s wages, and turn them over to the IRS and state taxing authorities as an advance toward the employee’s income taxes.

Payroll tax, which funds things like Social Security and Medicaid, is paid at the federal level. Employees and employers split the cost of these taxes.

You must withhold the employee’s portion of payroll tax from their wages, and then turn it in to the IRS together with your portion of payroll taxes.

Together, income tax and payroll tax are commonly known as “employment taxes.”

Triggering Sales or Income Tax Nexus with Remote Employees

Sales and use taxes create a separate issue that many people forget when discussing remote work. Although these taxes aren’t directly related to payroll, they can be affected by your employees’ locations.

Sales and use taxes are collected from customers and paid directly to the state by a company. You only need to collect and remit these taxes for states where you meet minimum requirements of doing business in that state—formally known as triggering sales tax nexus.

Sales tax nexus varies state to state, and so do the laws governing what is subject to sales and use tax. But in many cases, having a remote employee in the state is enough to trigger nexus. Be sure to review the relevant state laws (or consult a tax professional) to see if you’ll need to file sales and use taxes in additional states.

Similarly, you may trigger income tax nexus by hiring an out-of-state employee. In this case, your business would need to file multiple state income tax returns. The business’s income tax would effectively be split between your resident state and any other states where you’ve hit income tax nexus. Because each state has its own income tax rate, this could result in higher tax payments.

Now that we’ve covered the background info, let’s look at some examples of remote working tax implications.

Taxes for a Remote Employee in Your State

If you have an employee working from home in the same state where your business is located, then your situation is simple! Your state tax withholding will be unaffected; just be mindful of any local taxes that may apply.

Scenario: You own a company in Chicago, Illinois. One of your employees, Sarah, started working from home after having her first child. She lives in Illinois.

The Tax Situation: Since Sarah is working in the same state where your company is located, you will not have any additional tax obligations. You’ll withhold federal and Illinois taxes exactly the same as if Sarah was coming into the office.

Taxes for Remote Workers in Another State

This is where things can get tricky, as each state has its own laws—but it’s nothing a good payroll program can’t handle! In most cases, you’ll withhold taxes from your remote employee based on the state where they work, and not where your company is based.

Some states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming—don’t have state level income tax. New Hampshire and Tennessee charge tax on investment earnings, but not on wages.

If your remote employee works in any of these states, you may not need to withhold state level income tax, but you do need to withhold federal income taxes and payroll taxes.

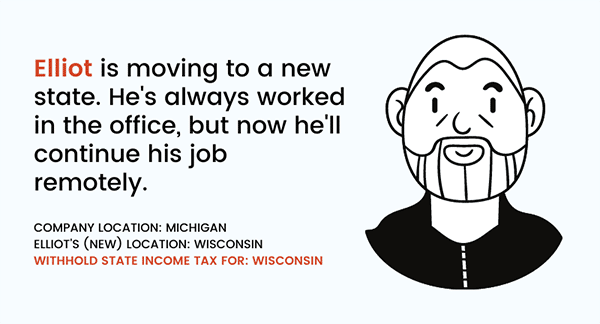

Scenario: You own a business in Michigan. One of your senior employees, Elliot, is moving to Wisconsin and will continue his work on a fully remote basis.

The Tax Situation: Once Elliot moves to Wisconsin, you must begin withholding his state employment taxes for Wisconsin instead of Michigan. You’ll need to register with the Wisconsin tax board and follow the filing schedules for Wisconsin employment tax returns.

By having an employee located in Wisconsin, your company will be subject to that state’s sales and use tax reporting requirements.

Finally, depending on Elliot’s compensation level, income tax nexus may have been triggered in Wisconsin, requiring your business to file an annual Wisconsin income tax return.

Remote Employee Taxes When Your Company is In a Convenience-Rule State

As we mentioned above, some states have “convenience of the employer” rules. If your company is based in one of these states, then a remote employee would pay their income and payroll taxes to the state where your company is located, even if they work somewhere else.

Make sure your employee knows that they’ll need to file a nonresident income tax return for your state and a resident tax return for the state where they live. Without proper filing, they could get double taxed on their income.

States with convenience of the employer rules:

- Arkansas

- Connecticut

- Delaware

- Nebraska

- New York

- Pennsylvania

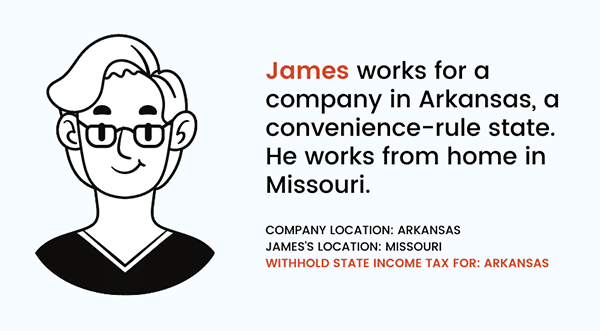

Scenario: You have a company in the state of Arkansas. One of your employees, James, works from home in Missouri.

The Tax Situation: Arkansas is one of six states with “convenience of the employer” rules, which means that James will have to pay income taxes to Arkansas (the state where his employer is based) even if he never sets foot in the state. He’ll file a resident tax return for Missouri and a nonresident income tax return for Arkansas.

To avoid being double-taxed on his income, James can take the amount of tax he paid to Arkansas and claim it as a credit on his Missouri tax return. (But you may not be able to take this type of credit in some situations.)

As James’s employer, you must withhold state level income taxes for Arkansas and not Missouri.

Remote Working Tax Implications: Triggering Sales and Use Tax

For most states, having an employee working in the state for more than a few days is enough to create sales tax nexus (aka a requirement to file sales and use taxes in that state).

A company will typically collect sales tax on the revenue that’s generated by selling to customers located in that state. The company will then account for and remit those taxes to the state on a tax return.

However, each state is different, and you should examine the laws on a case-by-case basis before hiring a remote employee.

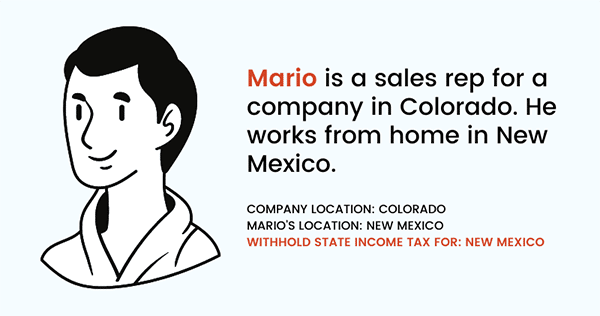

Scenario: You’re hiring a new sales representative for your company based in Denver, Colorado. Since the work can be done remotely, you’re open to candidates from any state. You decide to hire Mario, who lives in New Mexico and will be working from his home office.

The Tax Situation: Your company will withhold income taxes from Mario for New Mexico, where he works—not Colorado, where your business is based. You’ll also withhold his federal payroll taxes.

But, aside from the employment taxes that you’ll withhold from his paycheck, you may also trigger sales tax nexus in New Mexico by hiring Mario. In that case, you’ll have to collect sales and use taxes from customers who are located in New Mexico, and then remit those taxes to the state on a tax return.

Remote Worker Tax Implications: Temporarily Working in Another State

What if your employee works out of state only some of the time? Since employment taxes are based on where the employee is working, rather than where they live, you should adjust your tax withholding accordingly.

Scenario: Your company is based in Atlanta, Georgia. You have a work-from-anywhere policy to keep employees happy. Your employee Joanna lives in Georgia, but each year, she visits her parents in New York for 2 months and works remotely from their house.

The Tax Situation: While Joanna is working in New York, she will be subject to New York state tax laws. As the employer, you must withhold Joanna’s income tax for Georgia while she’s working in Georgia and withhold her income tax for New York while she’s working in New York.

Joanna will file a resident state tax return for Georgia and a non-resident income tax return for New York. The amount of income tax she pays New York can be claimed as a credit on her Georgia tax return.

As you can see, each remote work situation is unique. You must consider the laws of your state, your remote employee’s state, and how they interact with each other.

It’s certainly possible to hire your dream employee regardless of their location—just be sure to consult a tax professional before setting that job listing to “anywhere”!