The start of this year has seen a noticeable increase in CP2000 audit notices from the IRS, particularly affecting users of Robinhood and BlockFi. Our office has been fielding more inquiries about these notices related to tax year 2021, signaling the IRS’s intensified focus on cryptocurrency transactions.

Remember, if you receive this notice, you don’t have to face the IRS alone. Here’s what you need to know.

Understanding the CP2000 Notice

A CP2000 notice, or “underreporter inquiry,” is issued by the IRS when there’s a discrepancy between the income or payment information on your tax return and the data received from third-party entities. This includes cryptocurrency exchanges such as Robinhood and BlockFi.

Reporting cryptocurrency on your tax return can be complex and prone to errors. If you’re a crypto investor and receive a CP2000 notice, you may not have reported your trades fully or accurately in the eyes of the IRS.

Robinhood issues Form 1099-B, reporting all trading activity on the platform, while BlockFi issues Form 1099-MISC, reporting certain types of income (such as income from staking).

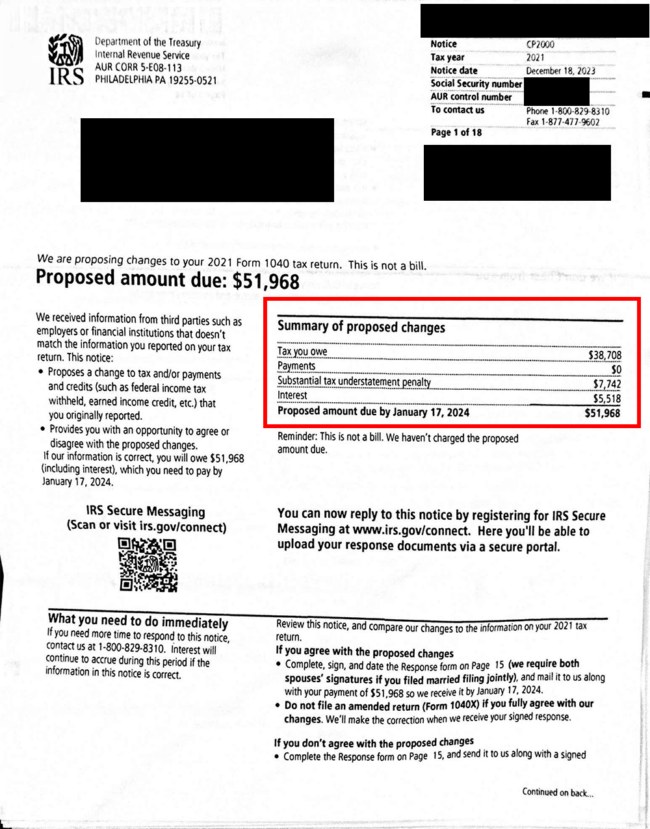

Here’s an example of a recent CP2000 letter for crypto:

Potential Triggers for CP2000 Notices

If you’re involved in crypto through platforms like Robinhood or BlockFi, a CP2000 notice might be due to:

- Mismatches in reported income or transaction details.

- Omissions in declaring all cryptocurrency activities.

- Reporting errors from third-party platforms.

Immediate Action Steps

Upon receiving a CP2000 notice, you should:

- Review the notice carefully and note the deadline for a response.

- Contact a tax audit attorney if you believe the numbers are incorrect.

- Respond within the typically 30-day response window (if you hire an attorney, they can respond on your behalf, which is recommended).

Ignoring the notice can escalate to further tax debt or penalties.

The Importance of Professional Guidance

Dealing with a CP2000 notice, especially with complex crypto transactions, can be daunting. In such cases, consulting with a tax attorney knowledgeable in both cryptocurrency and IRS audit defense is crucial.

The tax attorneys at Gordon Law have successfully reduced CP2000 tax bills for countless crypto investors. In many cases, we can reduce the bill by many thousands of dollars.

However, a successful outcome requires complex accounting and a thorough understanding of IRS audit procedures. You don’t have to face the IRS on your own or automatically accept the numbers they give you. Reach out today to speak to an experienced crypto tax attorney.

Reach Out to Gordon Law

Gordon Law has successfully helped many crypto investors receiving CP2000 letters. Benefits of hiring Gordon Law include:

- Attorneys and accountants with 10+ years of experience in both cryptocurrency taxation and IRS audit defense

- Track record of success in crypto tax audits. Some clients have saved more than $400,000 on taxes and penalties!

- No need to speak to the IRS yourself in most cases

- Clear, honest, and judgment-free guidance every step of the way

- Protect your rights and reduce the risk of escalating the issue

Broader Implications for Crypto Traders

While Robinhood and BlockFi users are currently in the spotlight, it’s important to note that users of other exchanges might find themselves in similar situations.

Other popular exchanges that issue tax forms include:

- Coinbase

- Crypto.com

- Binance

- Kraken

- Gemini

Staying vigilant about your tax reporting responsibilities across all platforms is more crucial than ever. Not sure how to report crypto correctly? Check out our detailed blog post on cryptocurrency tax reporting.

Staying Ahead in the Evolving World of Crypto Taxation

The rise in CP2000 notices to Robinhood and BlockFi users is a reminder of the increasing IRS attention on cryptocurrency. If you receive such a notice, prompt action and informed guidance are key. Our firm, with a thorough understanding of cryptocurrency transactions and IRS processes, is ready to assist you in navigating these complex situations.

For a deeper understanding of these notices, check out our detailed article on how to respond to CP2000 notices for crypto trading.

Remember, staying informed and proactive is your best defense against potential tax issues! Don’t hesitate to reach out if you have any questions.