Navigating the New BOI Reporting Requirements: A Guide for Businesses

FASB Unveils First-Ever Crypto Accounting Rules, Signaling Significant Business Changes

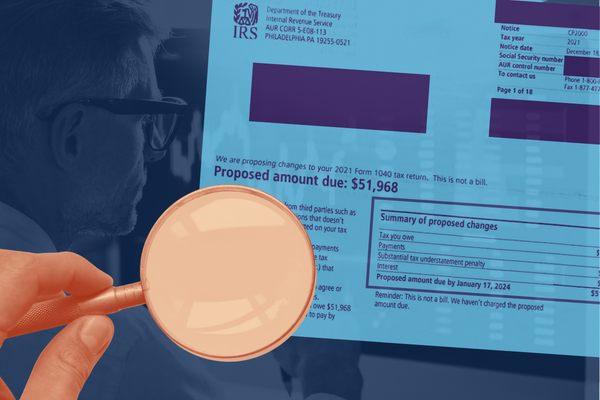

Robinhood and BlockFi Users Receiving CP2000 Audit Notices in 2024

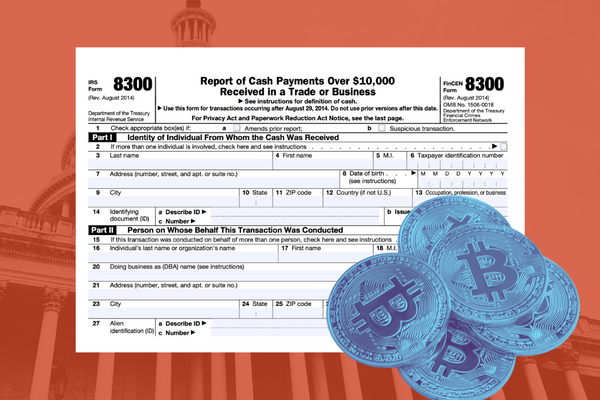

IRS Delays Reporting of $10K Crypto Transactions on Form 8300

Small Businesses, Act Now: Limited-Time IRS Relief for Employee Retention Credit Errors

Prepare for Audits: Kraken Will Send Data on 42,000 Users to the IRS

Partial Ripple Victory: Judge Rules That XRP Is Not a Security