As tax season approaches, our team has received many questions about the new 1099-K reporting threshold of $600. The good news is that this change has been delayed once again, so you don’t need to worry about the $600 threshold when filing your 2023 tax return.

However, it’s important for taxpayers—especially businesses or self-employed individuals—to understand their requirements and stay on top of IRS updates.

With all the confusion surrounding Form 1099-K, our team of seasoned tax professionals want to make sure you feel confident going into this tax season. We’ll break down everything you need to know about 1099-K reporting and the $600 threshold.

Understanding the Changes to 1099-K Reporting Rules

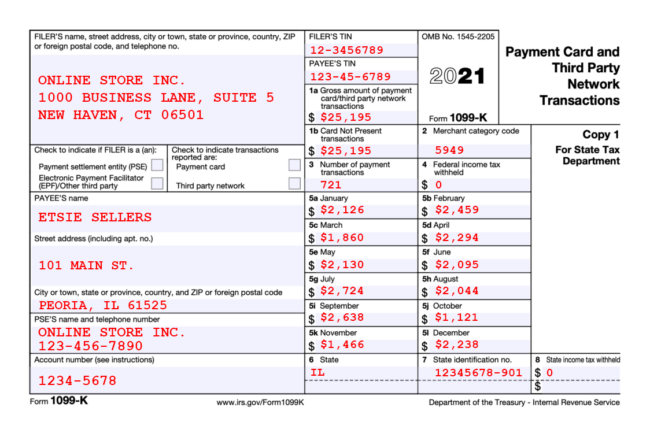

Form 1099-K is issued by third-party payment processors like PayPal, Venmo, and CashApp, as well as eCommerce platforms such as eBay, Etsy, and Facebook Marketplace. In most cases, it reports business transactions, but it can also be used for cryptocurrency tax reporting.

Here’s an example of Form 1099-K issued to an ecommerce seller:

- Historically, Form 1099-K was used to report amounts exceeding $20,000 or more than 200 transactions within a calendar year.

- The threshold was set to dramatically lower to $600 for tax year 2022, regardless of the transaction count, due to legislation passed under the American Rescue Plan in 2021.

- This change aimed to improve tax compliance but raised concerns about the burden on taxpayers and businesses.

- Implementation of the $600 threshold has been delayed before. It was initially supposed to start for the 2022 tax year (meaning taxpayers would receive their forms in 2023). Then, it was pushed back another year, and now it’s been delayed a third time. The IRS is maintaining the current threshold of $20,000 and 200 transactions for now.

- Looking ahead, the IRS is considering a phased approach. This may begin with a $5,000 threshold for tax year 2024 before eventually moving to the $600 mark. The IRS is accepting feedback on the proposed rules.

Why This Matters

This delay offers taxpayers additional time to adapt to 1099-K reporting changes, ensuring that they are not unexpectedly burdened with new reporting requirements.

Moreover, it highlights the importance of staying informed and prepared as tax laws evolve, especially with the IRS seeking feedback on how to effectively implement future changes.

“We spent many months gathering feedback from third party groups and others, and it became increasingly clear we need additional time to effectively implement the new reporting requirements,” said IRS Commissioner Danny Werfel. “Taking this phased-in approach is the right thing to do for the purposes of tax administration, and it prevents unnecessary confusion as we continue to look at changes to the Form 1040. It’s clear that an additional delay for tax year 2023 will avoid problems for taxpayers, tax professionals and others in this area.”

Practical Tips: Understand Your 1099-K Tax Requirements

- Who Receives Form 1099-K?: Form 1099-K is typically issued either for business transactions or transactions on a cryptocurrency exchange. Despite widespread confusion and concern around the $600 reporting threshold, changes to Form 1099-K will have little to no impact on taxpayers who only use payment apps for personal, cash transactions.

- Understand the Difference: Not all transactions are reportable on Form 1099-K. Personal transactions, such as sharing expenses with friends or gifting, are not subject to these requirements. However, sales of personal items through online platforms like eBay could be included on Form 1099-K, even though they aren’t taxable. Contact a tax professional if you have any questions.

- Choose Wisely: When using payment apps, selecting the correct transaction type can prevent unnecessary reporting. Ensure you’re marking payments as “friends and family” when applicable.

- Report All Income: Remember, all income is reportable, whether or not you receive Form 1099-K or any other tax form. If you need help preparing your business tax returns, self-employed tax returns, or cryptocurrency tax returns, reach out to our experienced team.

- Stay Informed: As the IRS fine-tunes its approach, staying on top of updates is key to avoiding surprises during tax season.

Need Help Understanding Your Taxes?

At Gordon Law, we understand the complexity of tax regulations and the impact of new reporting requirements on taxpayers.

Our team is always ready to assist you with tax return preparation and any questions you may have about your taxes. We believe that everyone deserves a stress-free tax season, and we’re here to make yours as smooth as possible!

Looking Ahead

The IRS’s decision to delay and reconsider the 1099-K reporting threshold highlights the balance between tax compliance and taxpayer convenience. As we await further guidance, staying informed and consulting with knowledgeable professionals can ease the transition.

For more insights and updates on tax reporting requirements, or if you need assistance with your tax returns, reach out any time.