In the ever-evolving world of cryptocurrency and blockchain assets, the savvy investor knows that every move counts. At Gordon Law, we help crypto investors pay less tax and avoid IRS problems. As the end of the year draws closer, we want to share a powerful strategy you can use to uncover hidden tax savings.

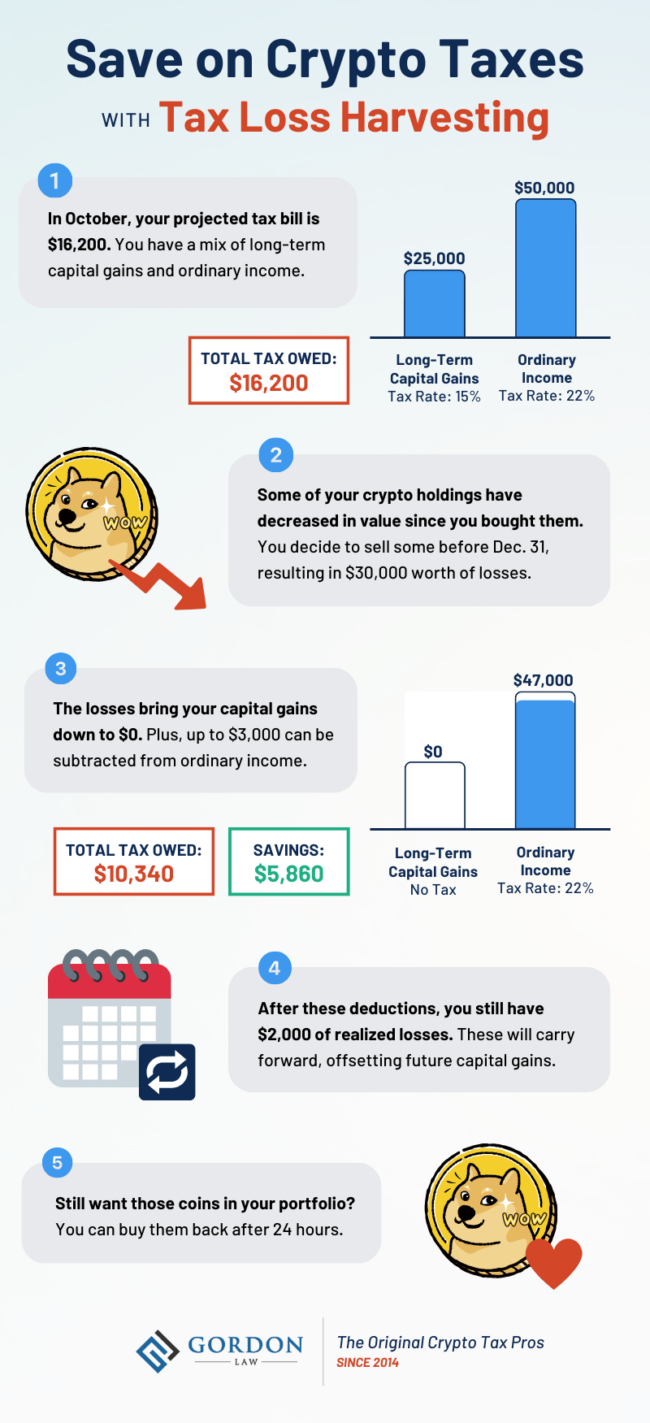

Crypto tax loss harvesting is a well-known strategy for offsetting capital gains. Depending on your portfolio, tax loss harvesting can save you thousands on your tax bill. However, it’s typically focused on fungible tokens like Bitcoin or Ethereum.

But what about those seemingly worthless, illiquid NFTs languishing in your digital wallet? Turns out, they might just be your ticket to optimizing your tax strategy, thanks to a game-changing strategy known as illiquid NFT tax loss harvesting.

Unlocking the Power of Tax Loss Harvesting

In the world of traditional investments, tax loss harvesting is a tried-and-true strategy employed by savvy investors to offset capital gains and minimize tax liabilities.

To make the most of your unprofitable NFT trades, you’ll need to realize the losses by selling the assets. This process allows you to offset capital gains effectively. You can counteract as many gains as you have in the year, or up to $3,000 of regular income. You can also carry your losses forward into future years.

The Illiquidity Conundrum

Applying the tax loss harvesting tactic to NFTs has historically been a challenge for many investors. Some NFTs are illiquid due to abandoned projects or dreaded rug pulls. So how can you sell these NFTs and realize a capital loss?

Selling them on the open market isn’t possible—at least not any time soon. Most of these projects are dead, abandoned, and no longer supported by their creators, and that is well understood by the market. There simply are no buyers.

In the past, investors faced a grim reality: They couldn’t realize losses on these virtual collectibles for tax purposes, leaving their portfolios in a state of limbo.

The Scale of the Losses

There’s a significant opportunity for NFT investors to recapture some of their investment in the form of tax savings.

In September 2023, The Guardian reported that 95% of NFTs are now worthless, and over 23 million people own wallets that hold illiquid NFTs. Industry figures estimate that there are hundreds of millions in frozen tax deductions.

Turning these unprofitable investments into tax savings can help unlock a new wave of capital for NFT investors.

Enter Unsellable: A Lifeline for Illiquid NFT Investors

Unsellable offers a lifeline to investors holding onto illiquid NFTs, finally allowing them to unlock tax savings. The company purchases these seemingly worthless assets for a nominal amount (the ETH equivalent of a single penny per token). This opens up a world of tax-saving possibilities for crypto investors.

Here’s How Unsellable Makes It Easy:

Unsellable takes the complexity out of tax loss harvesting with illiquid NFTs. Their user-friendly platform simplifies the process from start to finish. You can expect:

- Instant Liquidity: Unsellable provides you with the immediate liquidity you need for your NFTs. No more waiting for buyers or dealing with uncertain market conditions.

- Verified + Audited Smart Contract: Rest assured that your transactions are secure and transparent with Unsellable’s verified and audited smart contract.

- Low-Cost Bulk Transactions: Unsellable offers cost-effective solutions for bulk transactions, ensuring that you can maximize your tax benefits while spending the least amount possible on gas fees.

- CPA-Ready Receipt: Unsellable provides you with a CPA-ready receipt, simplifying the reporting process for tax purposes.

Leveraging Tax Benefits with Unsellable

The tax benefits of selling illiquid NFTs to Unsellable can be substantial, depending on what you’re holding. By unlocking capital losses, investors can optimize their tax strategy, potentially saving a significant amount of money.

That said, it’s crucial to collaborate with a tax professional to ensure compliance with tax regulations and reporting requirements. Still, this innovative strategy provides a much-needed lifeline for investors navigating the complexities of the crypto tax landscape.

Illiquid NFTs may have seemed like a dead end for investors, but Unsellable has changed the game. With their pioneering approach to tax loss harvesting, you can now convert those seemingly worthless digital collectibles into a valuable tax benefit.

If your digital wallet houses illiquid NFTs that have lost their luster, consider tax loss harvesting with Unsellable. Illiquid NFTs might just turn out to be your secret weapon in navigating the crypto tax terrain in 2023.

If you want to unlock even more savings, or simply eliminate the headache of filing crypto and NFT tax returns, reach out to the original crypto tax pros at Gordon Law Group to discuss your options. We make it easy for all crypto investors to file accurately and unlock advanced tax-saving strategies.