December is just around the corner, and if you’re a crypto investor, it’s time to think about your taxes! Many people wait until the last minute to ask our crypto accountants, “How can I pay less in taxes for this year?” But the earlier you act, the more chances you have to save.

Don’t miss your chance for significant tax savings—get ahead of the curve and master your crypto taxes before it’s too late. Here are 5 smart strategies you can use right now to lower that April tax bill.

1. Donate Your Crypto

Donating crypto that’s gained value can be a win-win for taxes. First, you won’t have to pay capital gains tax, which would apply if you sold the asset or traded it. Second, you can get a tax deduction!

Want to use this strategy? Follow these steps:

- Identify crypto assets that have gained value since you acquired them; this can include NFTs.

- Find a charity that accepts the asset(s) you wish to donate, and make sure it qualifies for tax-deductible donations.

- Send your cryptocurrency or NFTs to the charity directly—don’t convert to cash or trade for any other token first.

- Be sure to get a receipt for the donation. If the value of a donated NFT exceeds $5,000, you’ll need an official appraisal, as well (the charity should provide this).

2. Speed Up Your Business Spending

If you have a cryptocurrency business, consider spending money now on things you’ll need next year. This could include travel arrangements, annual software subscriptions, or new equipment.

If you’re planning to give year-end bonuses, you can distribute them in December instead of waiting until January. These expenses will offset your taxable income for the year.

3. Contribute to a Retirement Account

Traditional retirement accounts only let you invest in things like stocks and bonds, but with a self-directed IRA, you can also invest in crypto and other assets.

You might be able to get a tax deduction for adding USD funds to the account. Then, you can purchase crypto—most often Bitcoin—through the IRA. You won’t owe tax on any gains until you take the money out (with a traditional IRA) or you might never owe tax on the gains (with a Roth IRA).

Individuals can contribute up to $6,500 to Individual Retirement Accounts (IRAs) in 2023. You can have multiple IRAs, but the annual limit remains the same. Whether the contribution is fully or partially tax deductible depends on your employers’ retirement plan options and your income.

4. Hold Onto Your Crypto (HODL)

The length of time you hold onto your digital assets can greatly affect your crypto tax rates, so HODLing is one of the easiest ways to reduce your taxes.

If you sell crypto you’ve held for 1 year or less, the tax rate is the same as your income tax rate. This is high for some taxpayers, reaching up to 37%. Meanwhile, if you wait more than 1 year, you’ll have a more favorable tax rate: 0%, 15%, or 20%.

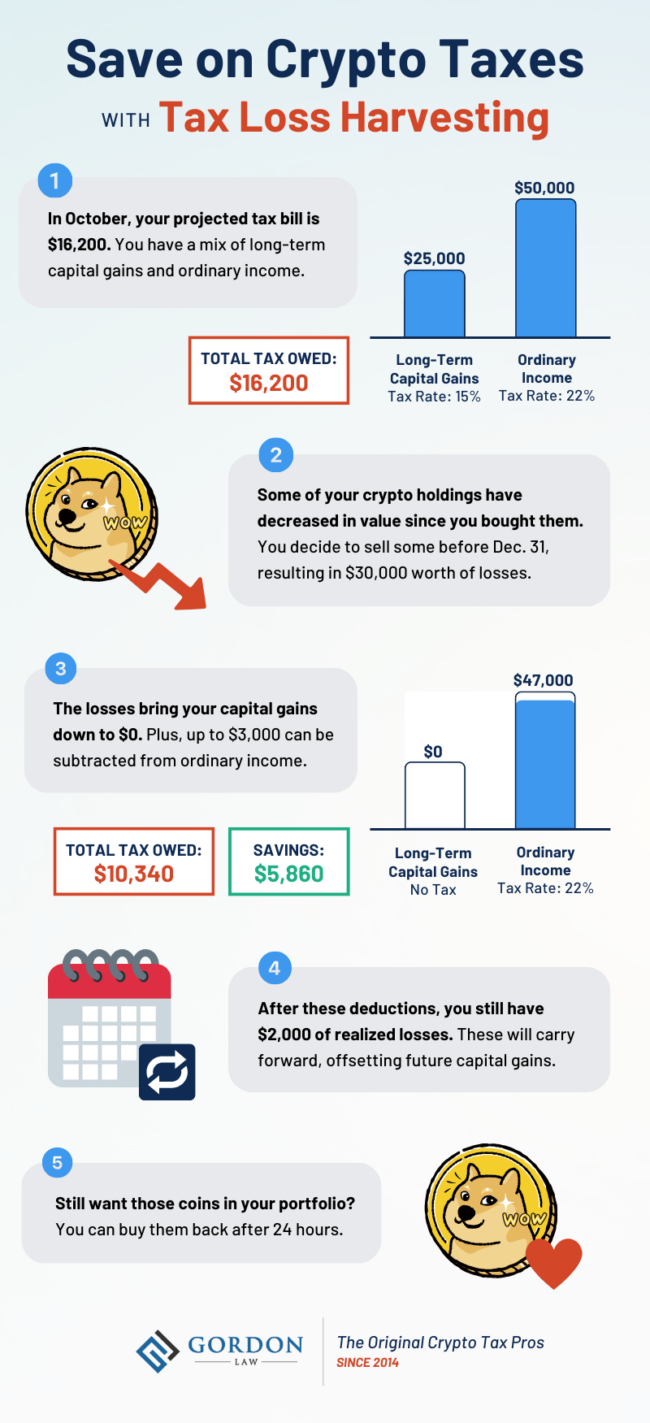

5. Realize Losses to Lower Your Taxes (Tax Loss Harvesting)

Perhaps the most powerful year-end strategy for crypto investors is tax loss harvesting. This strategy is especially useful in 2023 thanks to the drawn-out bear market.

Are you still holding crypto or NFT investments that have lost value? If so, you can realize a loss by selling the assets. These losses can offset other gains and lower your taxes. The losses can even be carried forward to future years—so when the next bull market comes, your losses from 2023 can still provide a tax benefit.

And here’s a bonus for crypto investors: the wash sale rule, which usually stops you from claiming a loss if you buy the same asset back quickly, doesn’t apply to crypto.

As always, consult with a professional to find the best tax saving strategies for your unique situation. By taking action now, you can make smart moves to lower your tax bill and keep more of your crypto gains.

Don’t wait until it’s too late! Reach out to Gordon Law Group today if you have any questions.