Form 1099-DA: What We Know So Far

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Schedule a confidential consultation! CONTACT US

“Communication was amazing with fast responses to all emails and questions.

SEE OUR CUSTOMER REVIEWSSchedule a confidential consultation! CONTACT US

Starting in 2026, the IRS will introduce Form 1099-DA dedicated to reporting crypto and digital assets. Learn who needs to issue this form and more!

New crypto accounting rules from the Financial Accounting Standards Board will provide more financial transparency for businesses with cryptocurrency on their balance sheets.

Did you just learn about FBAR filing requirements? Our experienced FBAR lawyers break down all you need to know about this form (otherwise known as FinCEN Form 114).

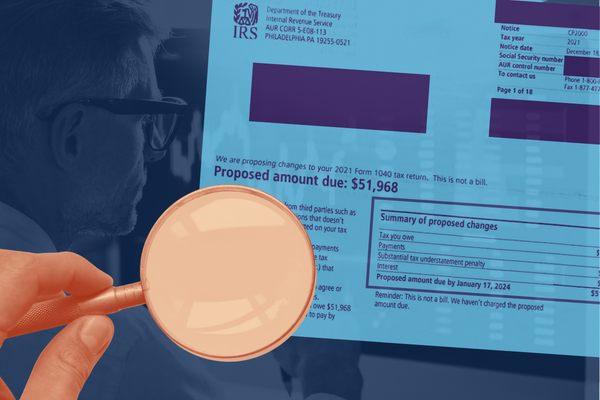

Are you a Robinhood or BlockFi user who’s received IRS letter CP2000? This is the start of a crypto tax audit. Here’s what you need to know.

2023 was a landmark year for cryptocurrency regulation, with several regulatory bodies vying for control over digital assets. What’s in store for 2024? The team at Gordon Law weighs in.

Good news for crypto businesses: A new requirement to file Form 8300 for cryptocurrency payments of $10,000 or more has been delayed pending further regulations.

Love them or hate them, NFTs are here to stay. Some only see a digital picture of an ape in human clothing. Others see an opportunity for creatives and artists to securely sell or trade with people all over the world via the blockchain. The NFT market has exploded over the last several years and shows no signs of letting up.

You may be eligible for automatic penalty relief and other tax debt relief options. Learn more here, and reach out to discuss your options.

IRS Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations,” has complex filing requirements. Not sure whether you need to file or how to file? This guide breaks down what you need to know.

Confused about IRS Form 8858, “Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches”? This guide from experienced international tax lawyers explains who needs to file and how to avoid penalties.

This guide to Form 8865, “Return of U.S. Persons With Respect to Certain Foreign Partnerships,” breaks down the essentials, including filing categories and who needs to file.

Get tax relief while you can! For a very limited time, the IRS is offering employers relief for repayment of the Employee Retention Credit (ERC). The new Voluntary Disclosure Program offers a significant discount on the tax owed, plus a waiver of interest and penalties.

Do you have hidden tax savings languishing in your wallet? Here’s how to unlock them and lower your bill.

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem.

Or, you can call us at

Submit your information to schedule a confidential consultation, or call us at (847) 580-1279